Principles at a glance

-

01

Build on her family-first mental model

↓

-

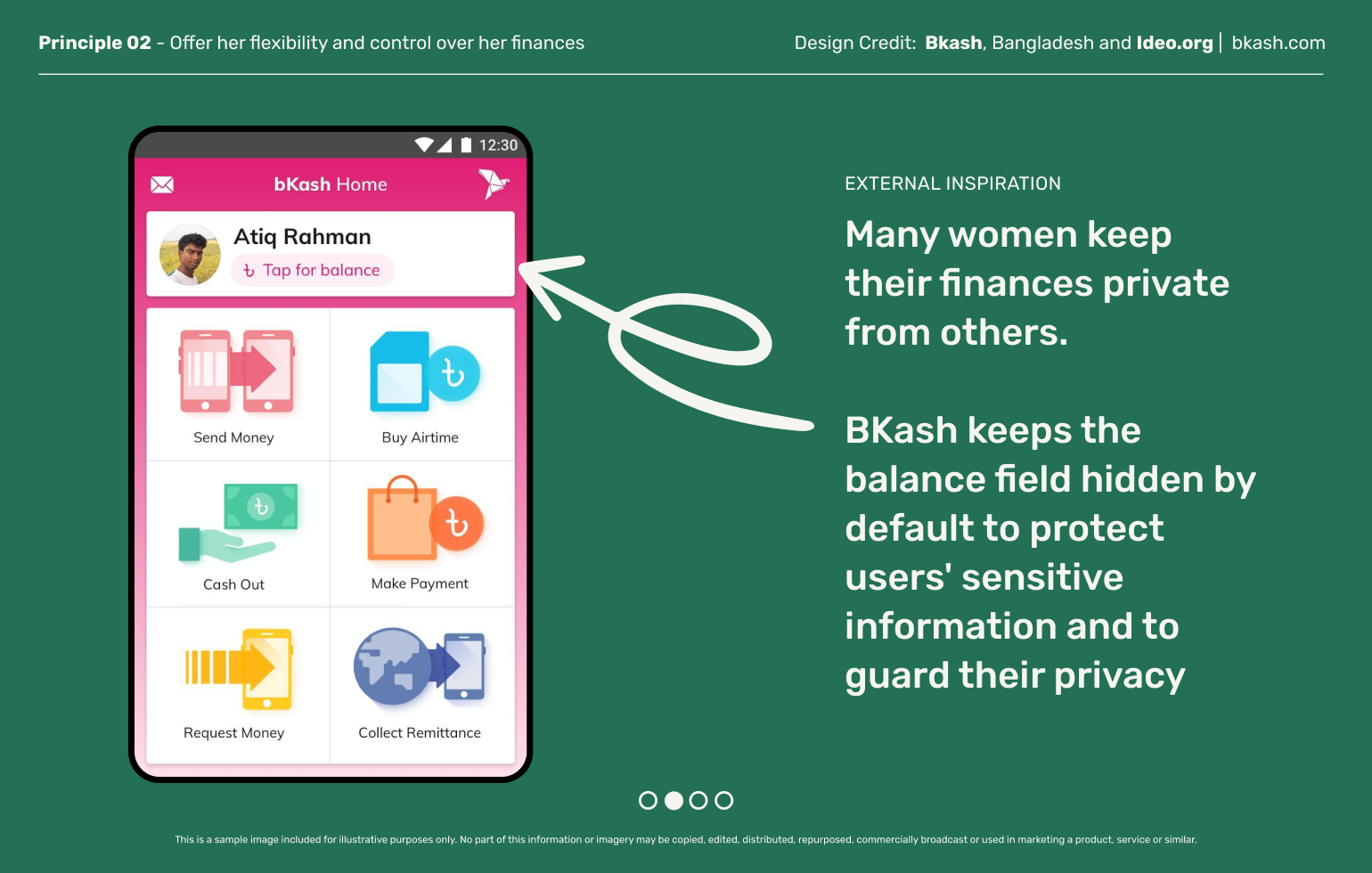

02

Offer her flexibility and control over her finances

↓

-

03

Celebrate her contributions and amplify her pride

↓

Principles in action

Build on her family-first mental model

Principle 01

Low-income women tend to operate collectively - making and acting on financial decisions with and for family members. The growth, safety, and approval of their immediate family are important considerations. It’s important to design for ways that allow her to include her family to the extent that feels right to her—whether that means helping her keep her money secure, or helping her anchor her finances in household goals.

Offer her flexibility and control over her finances

Principle 02

Low-income women experience more income uncertainty, so they often manage their money by saving more when they can, relying on social finance, and planning for unexpected expenses. Giving women greater control over their finances not only fosters more trust in a financial product, it enables women to reach their goals more effectively.

Celebrate her contributions and amplify her pride

Principle 03

Women often serve as invisible money managers in many households but are rarely rewarded for this critical role. A product that acknowledges, celebrates, and empowers her as an individual can increase her willingness to engage and build long-term customer loyalty.

Explore other moments in

Women x Finance

Explore other moments in Digital Payments & Remittances