Managing Money in Groups

Empower women to effectively leverage group based financial tools (like saving circles, SHGs, chit funds, etc.) to gain financial freedom

Principles at a glance

-

01

Build intentional transitions to digitized group finance

↓

-

02

Design for social connection in the digital world

↓

-

03

Showcase the superpower of digital to build trust

↓

Principles in action

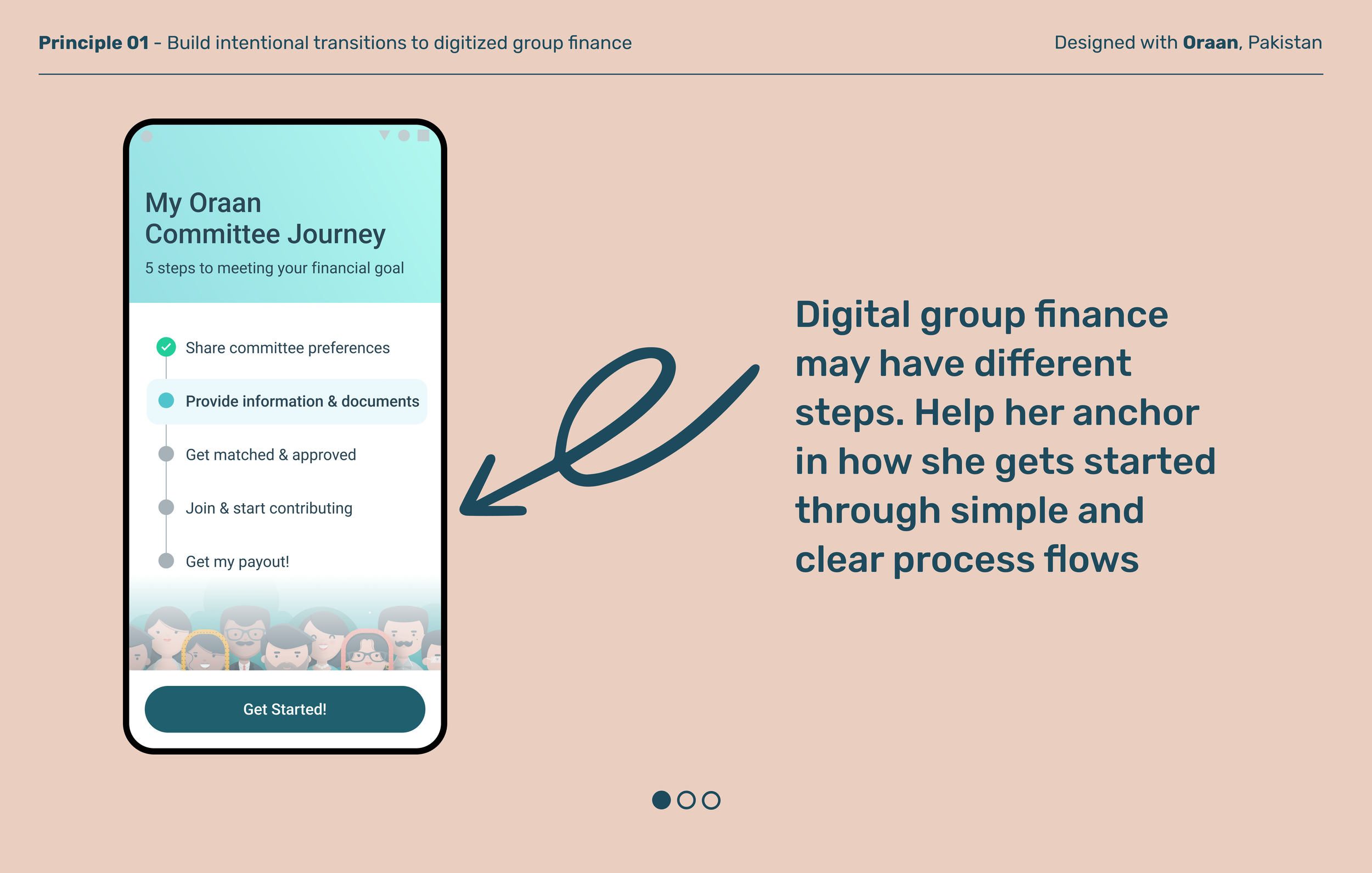

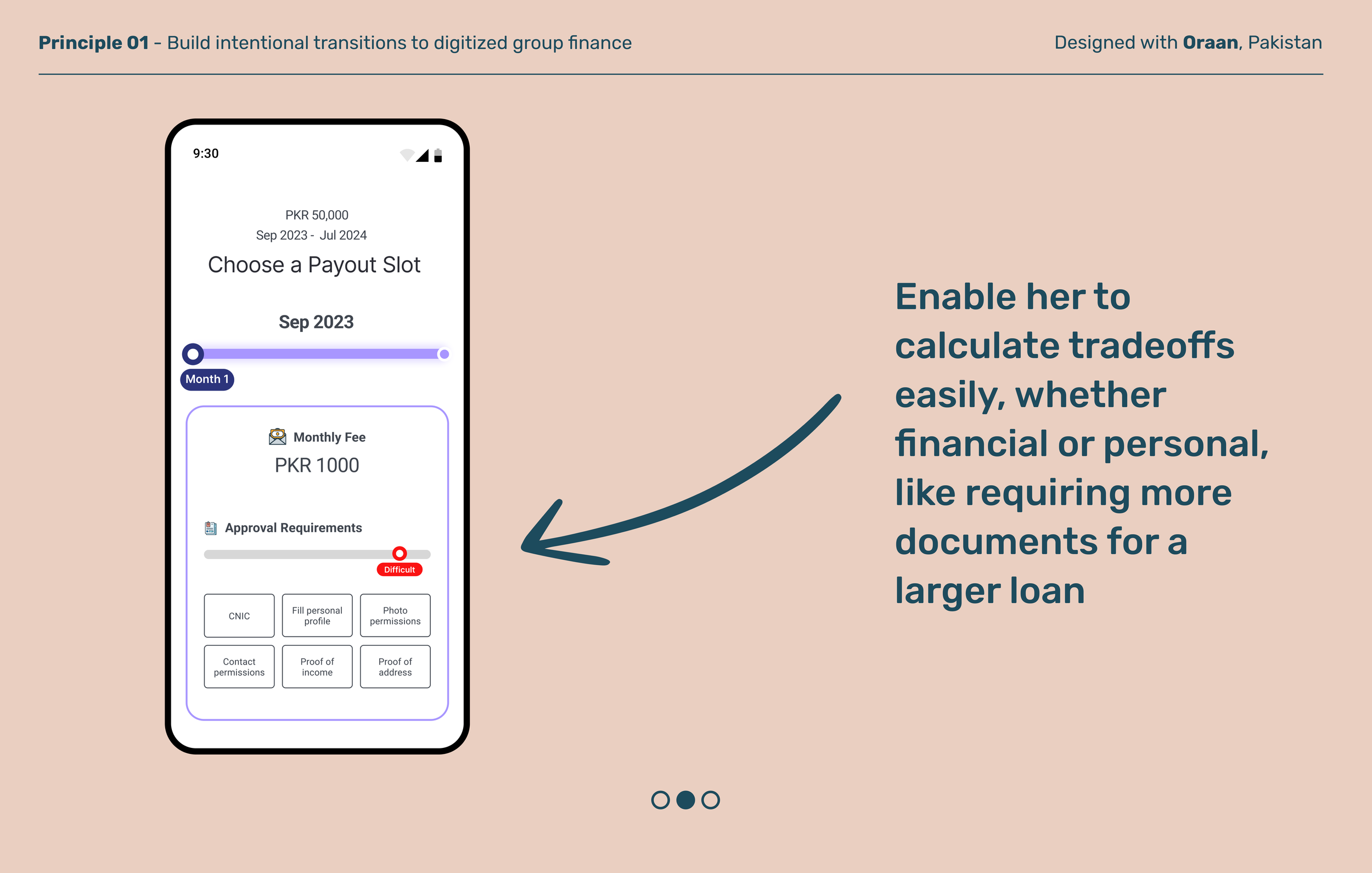

Build intentional transitions to digitized group finance

Principle 01

Many low-income women are familiar with group finance in the offline world. Digital-savings groups can build on this tried-and-true model but may surprise women with unexpected differences that become barriers.

Design for these transitions more intentionally, from how her identity is validated offline vs online to how she can find support when questions and issues arise. Designing intentionally can help avoid drop-off, poor performance, and negative reviews.

Principle 02

Design for social connection in the digital world

Collectives serve as safe spaces for women to share, be heard, and get support. Social connection is a key driver across these groups, which enable women to connect with other women. When groups go digital, social connection often gets lost: the face time, playful banter, and helpful gossip start to work differently or worse, go missing.

Design ways to preserve her social connections in a digital environment in order to help her remain engaged and supported by her peers, as well as by your product.

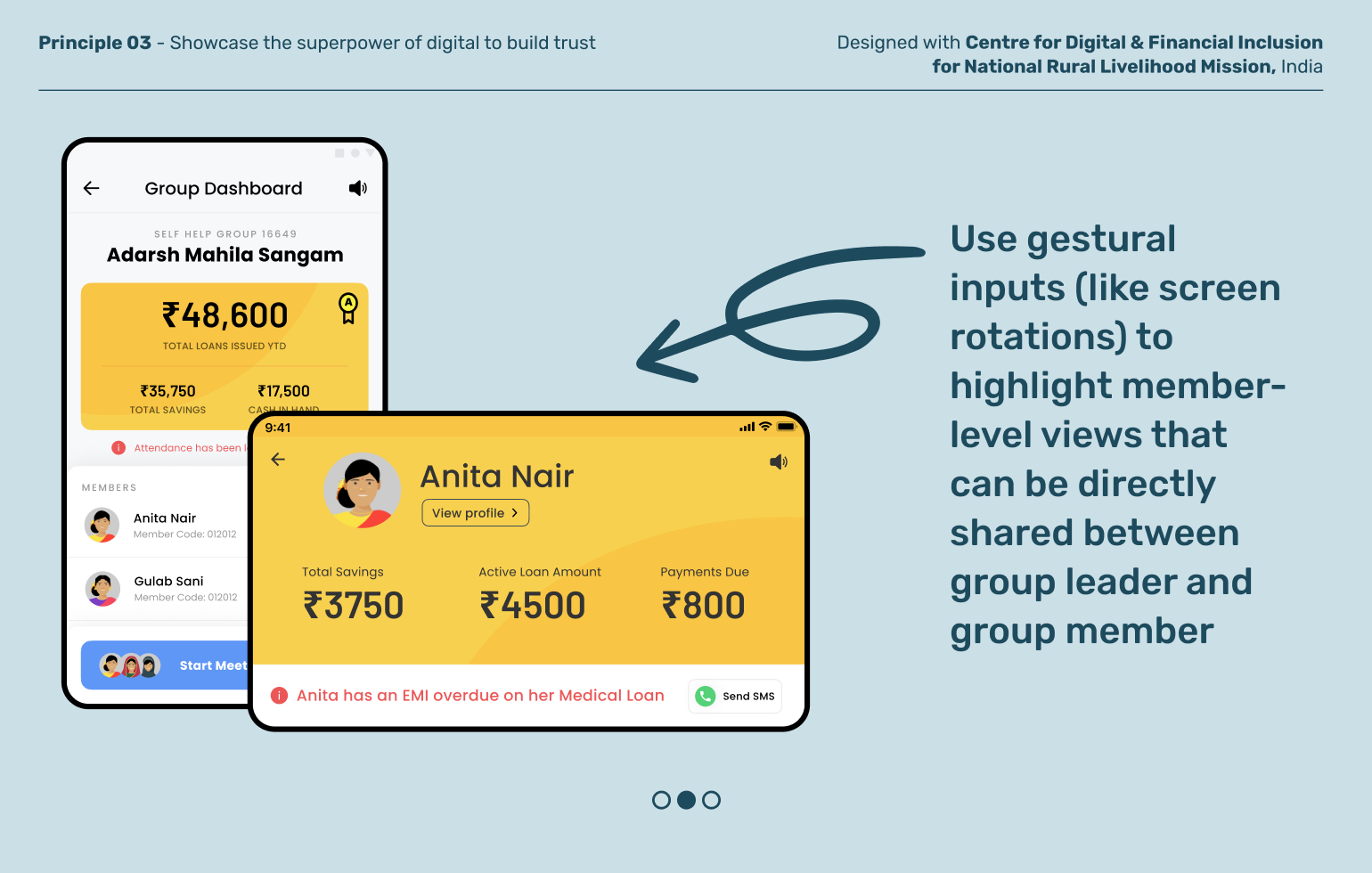

Principle 03

Showcase the superpower of digital to build trust

Transparency and accountability are important tenets in group-based finance because they help build strong relationships between group members and maintain shared responsibility.

Digital platforms can preserve transparency and accountability with features that give her more control over her money and encourage her to practice positive behaviors like timely deposits and loan repayments.

Explore other moments in

Women x Finance