Onboarding and Verification

Make onboarding feel trustworthy, intuitive and empowering

Principles at a glance

-

01

Build trust first and request information later

↓

-

02

Use language in verification flows that feel inclusive and empowering

↓

-

03

Design with social and gender norms in mind

↓

Principles in action

Build trust first and request information later

Principle 01

Women who have lower literacy or less baseline comfort and familiarity with technology are often protective of their personal information. They worry their data will be misused, or sharing it will cause harm for them or their family members. When it comes to onboarding, designing for women’s need for trust and safety, and creating information transparency become must-have design considerations.

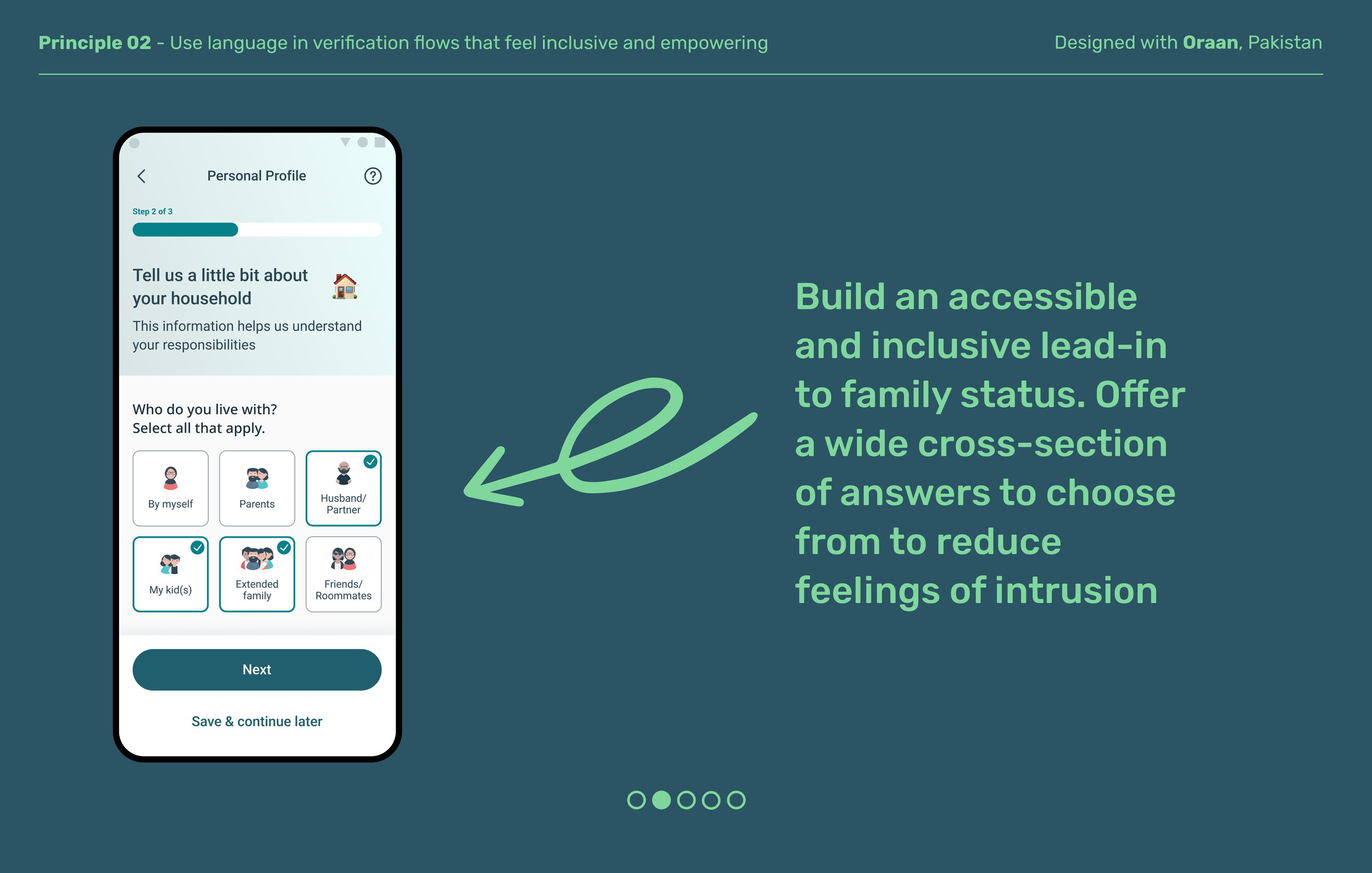

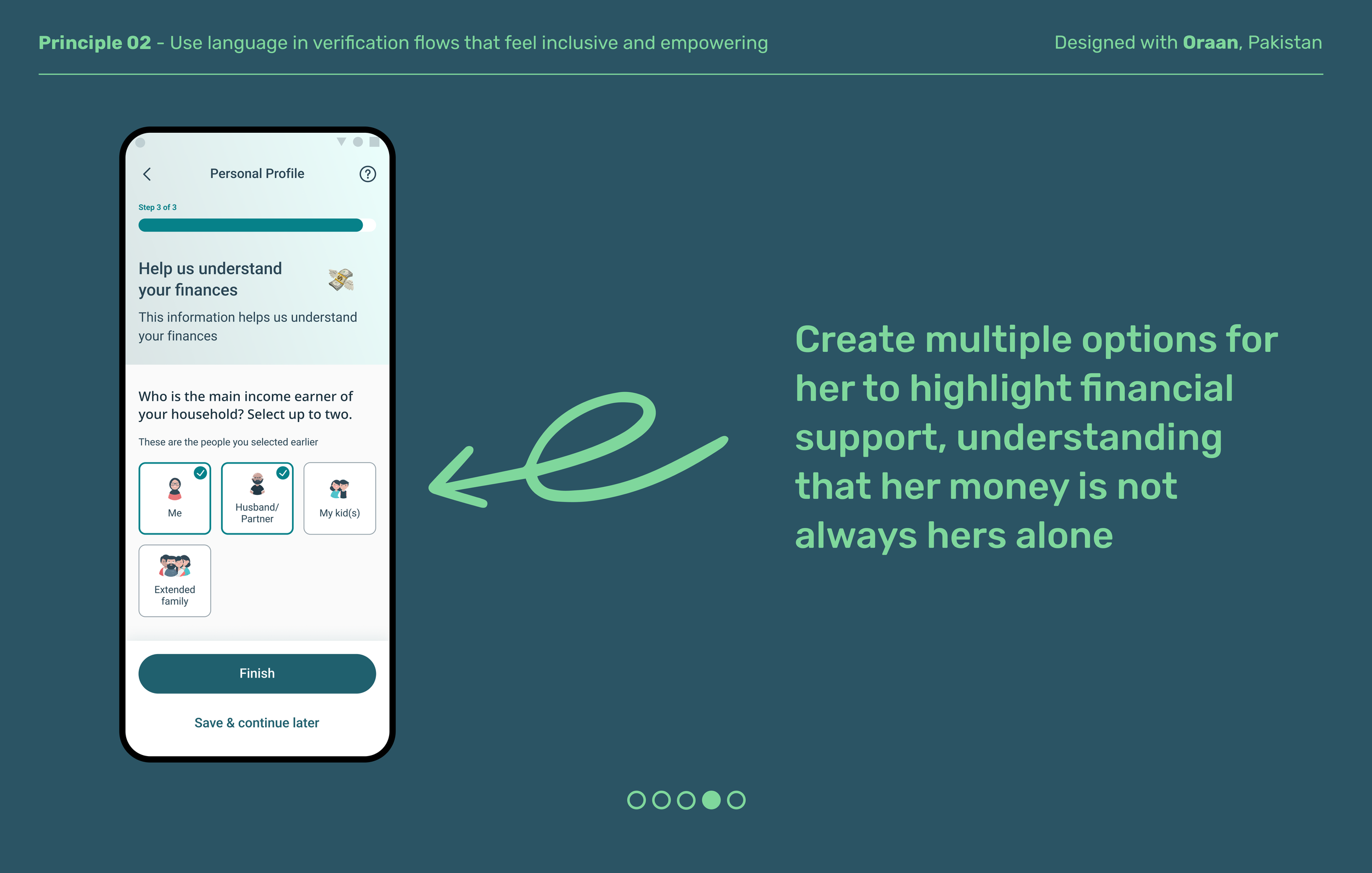

Principle 02

Use language in verification flows that feels inclusive and empowering

The language used in the banking industry’s Know-Your-Customer (KYC) process has become standard and remains largely unchanged. But for many low-income women, seemingly simple questions can trigger stigma about their socioeconomic status or recall shame from past experiences being excluded from the formal financial system. Rewrite questions around income, profession, and asset ownership to become more inclusive and empowering for women who may have fewer opportunities to participate formally in finance.

Principle 03

Design with social and gender norms in mind

Women are always navigating social structures and norms that make it difficult to have agency and be independent. Identify these constraints and design for the norms that she navigates by finding easier alternates that help her move beyond these limitations. You may find that inclusive-product changes benefit not only marginalized women, but also bring onboard many more users, too.

Explore other moments in

Women x Finance