Loan Application

Help users understand the terms of their first loan and onboard and apply with ease

Principles at a glance

-

01

Make credit a deliberate choice, not a foregone conclusion

↓

-

02

Simplify loan applications by thinking beyond typing

↓

-

03

Allow for consideration before committment

↓ -

04

Build trust with radically transparent credit decisions

↓

Principles in action

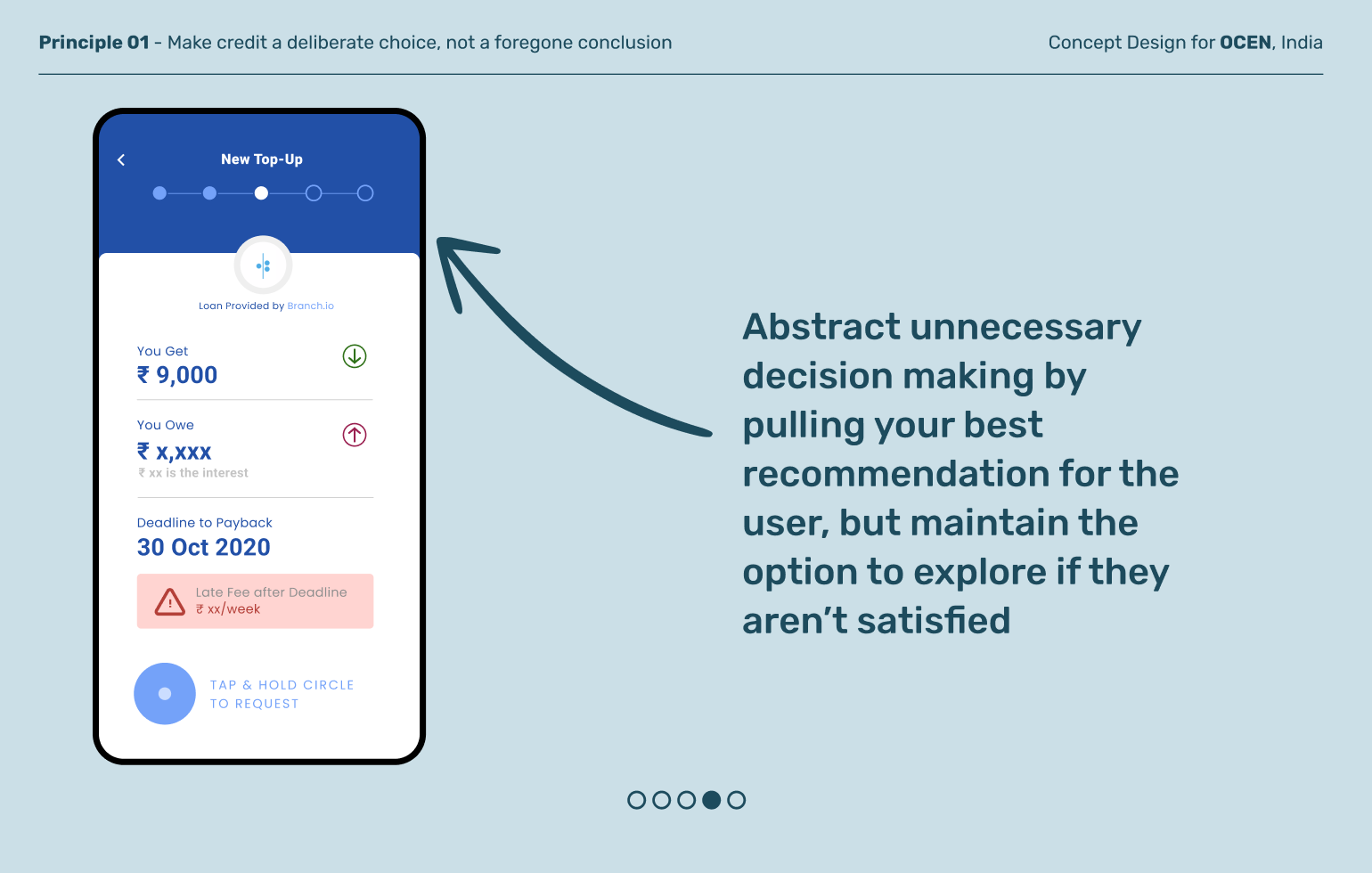

Make credit a deliberate choice, not a foregone conclusion

Principle 01

Selecting loan amount, duration, and repayment schedule are big choices. Forcing users to choose as fast as possible can be both overwhelming and frustrating. Good design balances flexibility and user agency with context-specific guidance and changeable defaults that help people get started.

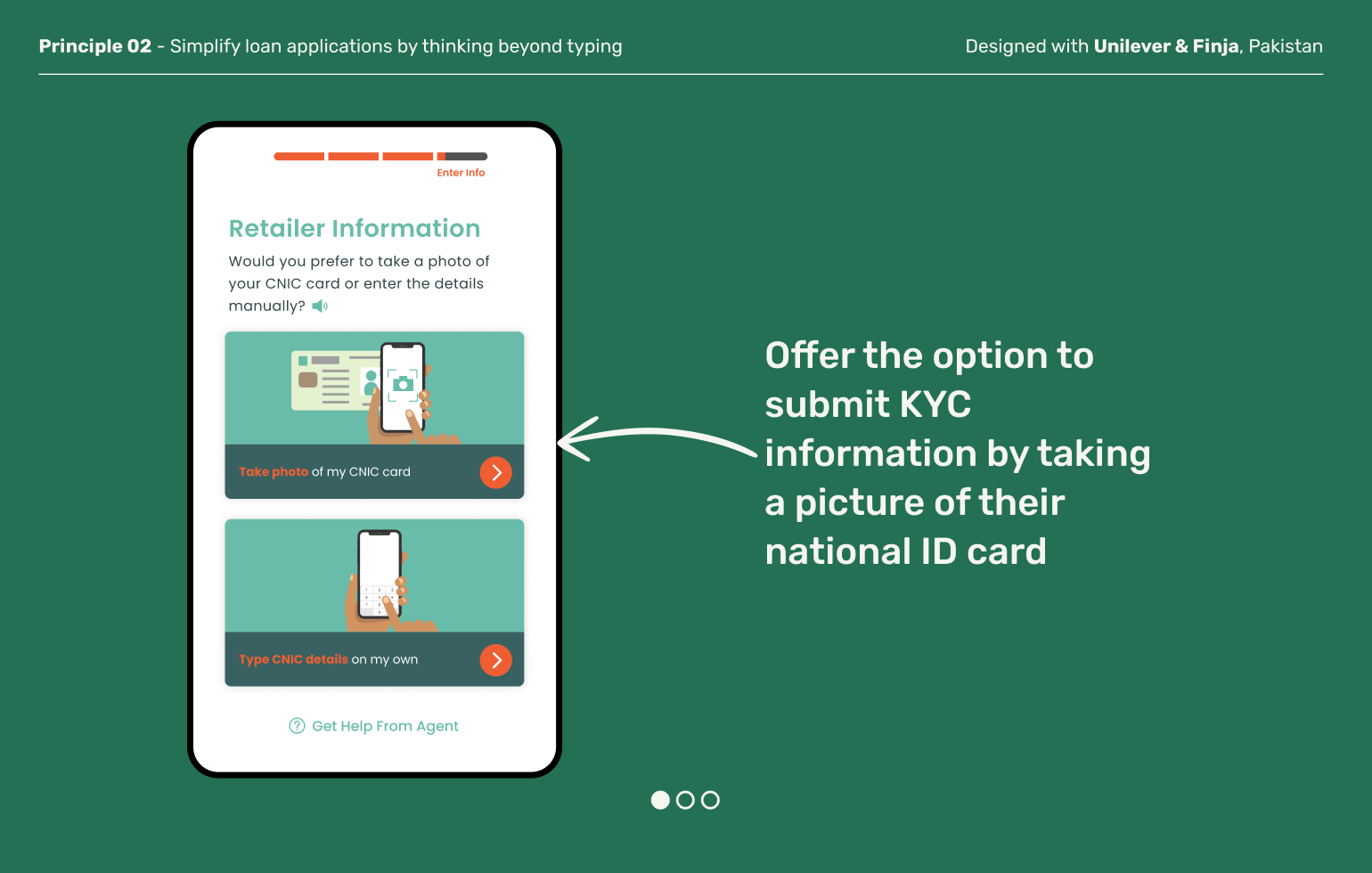

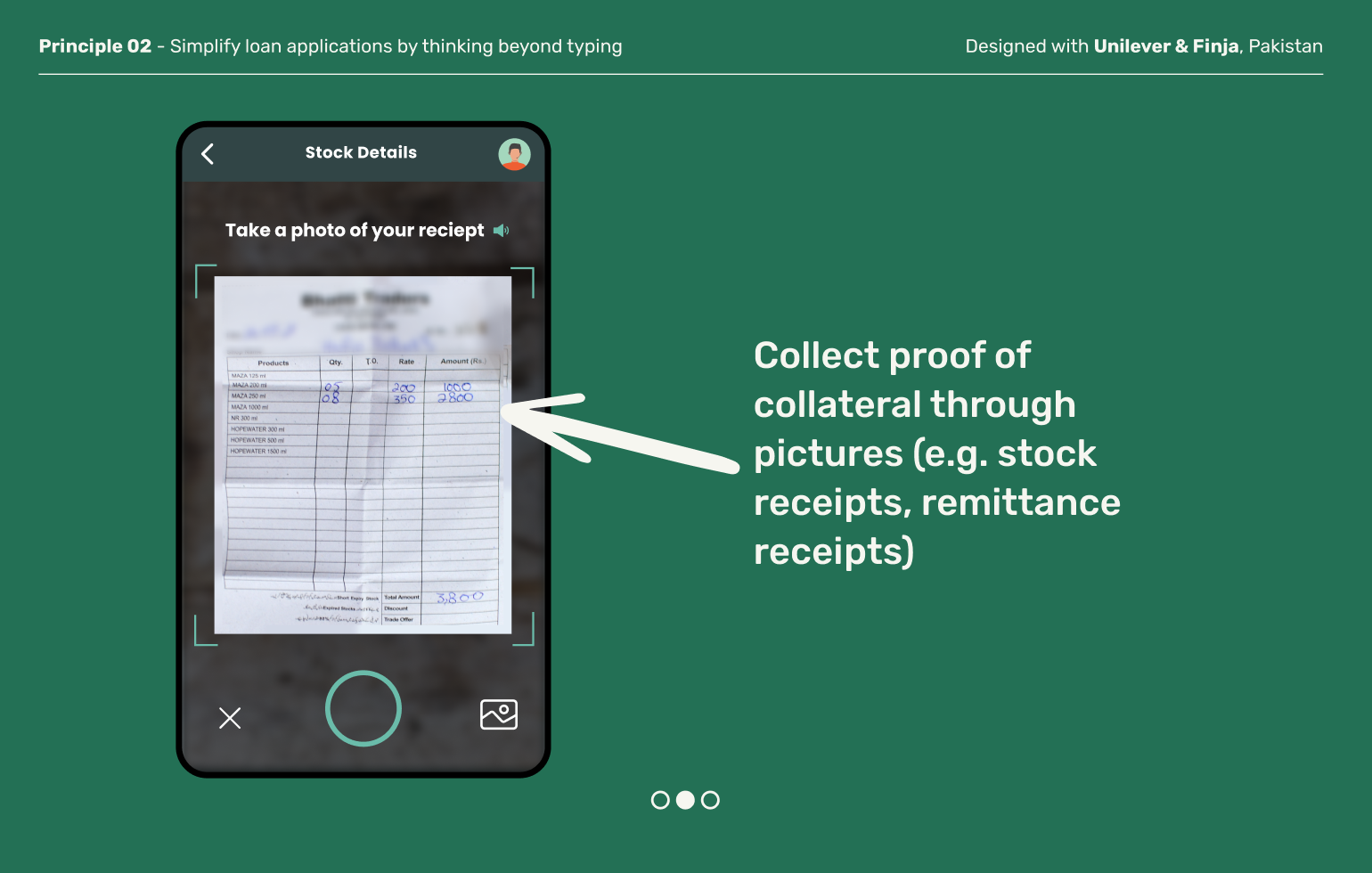

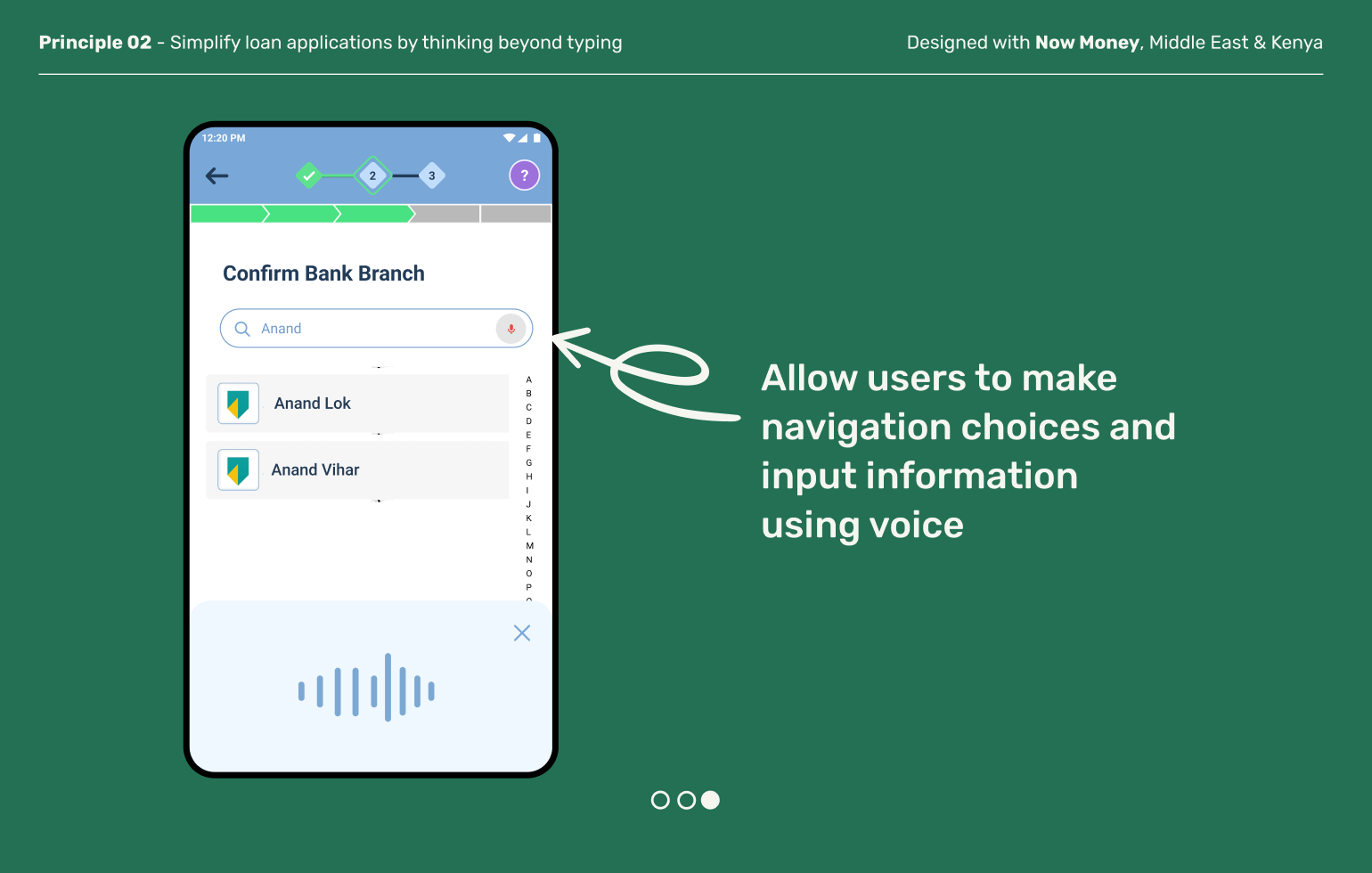

Simplify loan applications by thinking beyond typing

Principle 02

Typing is difficult and error-prone, especially when it comes to using numbers and special characters. Reduce the loan application burden and minimize errors by enabling multiple input options.

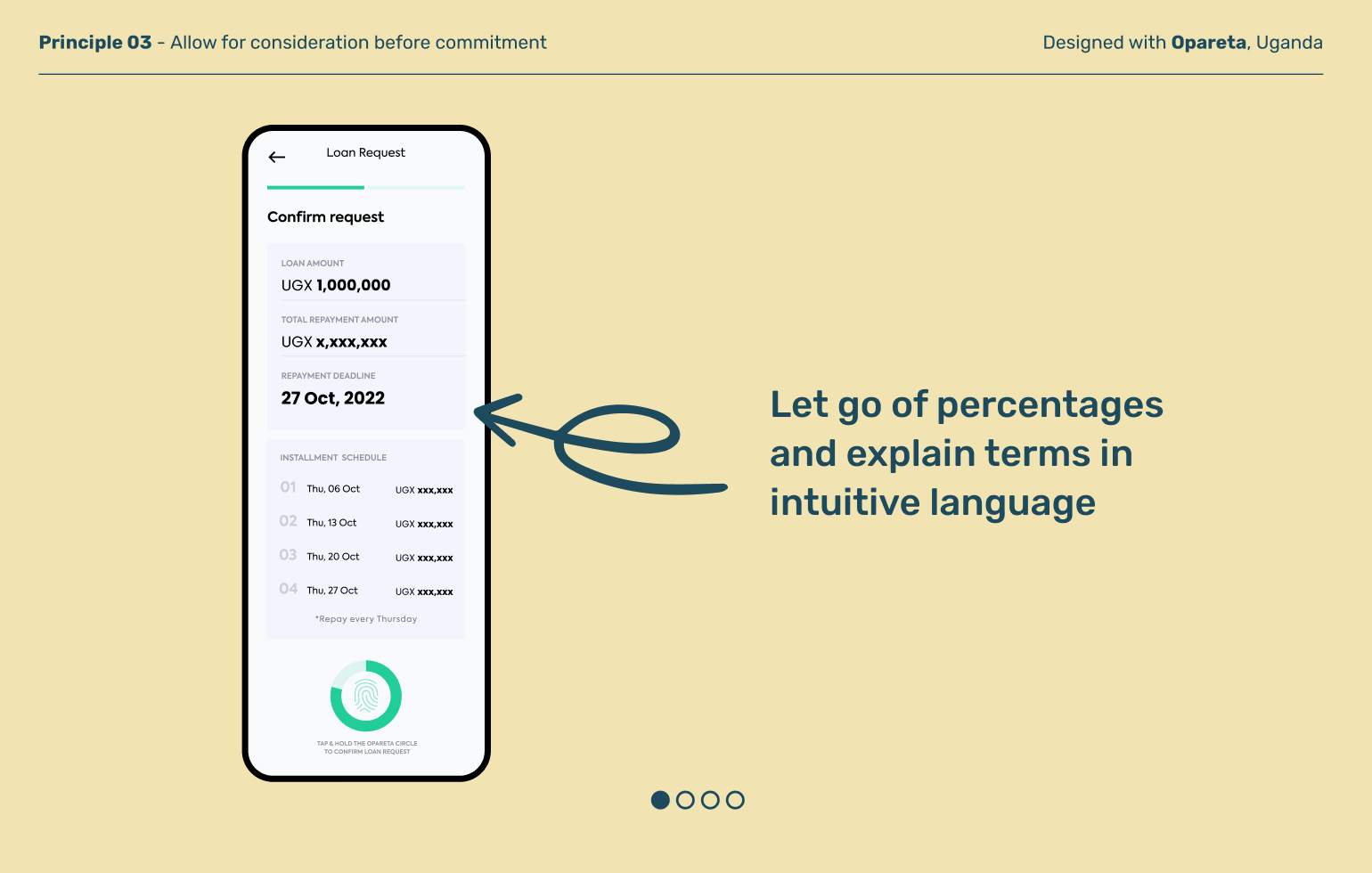

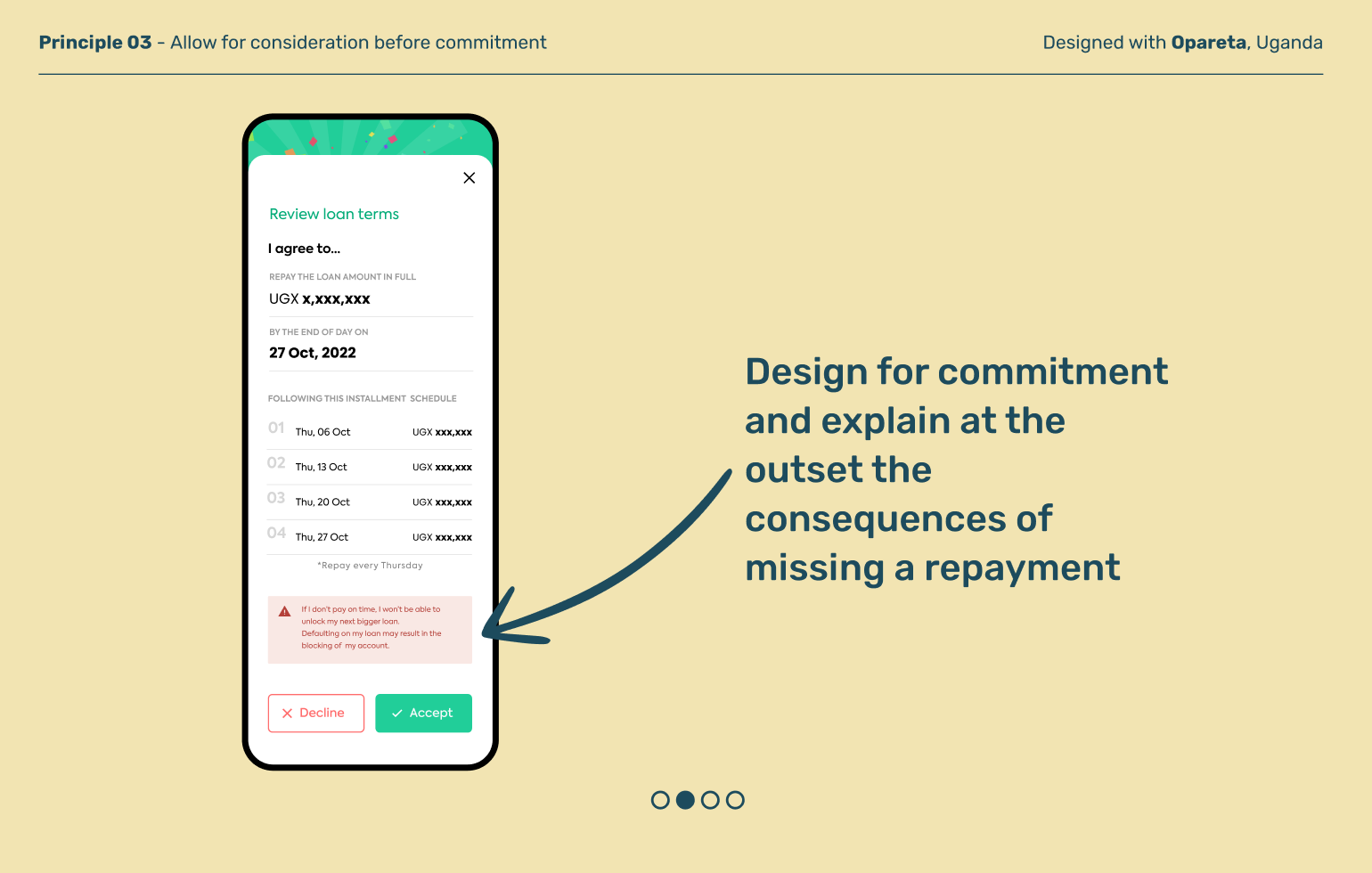

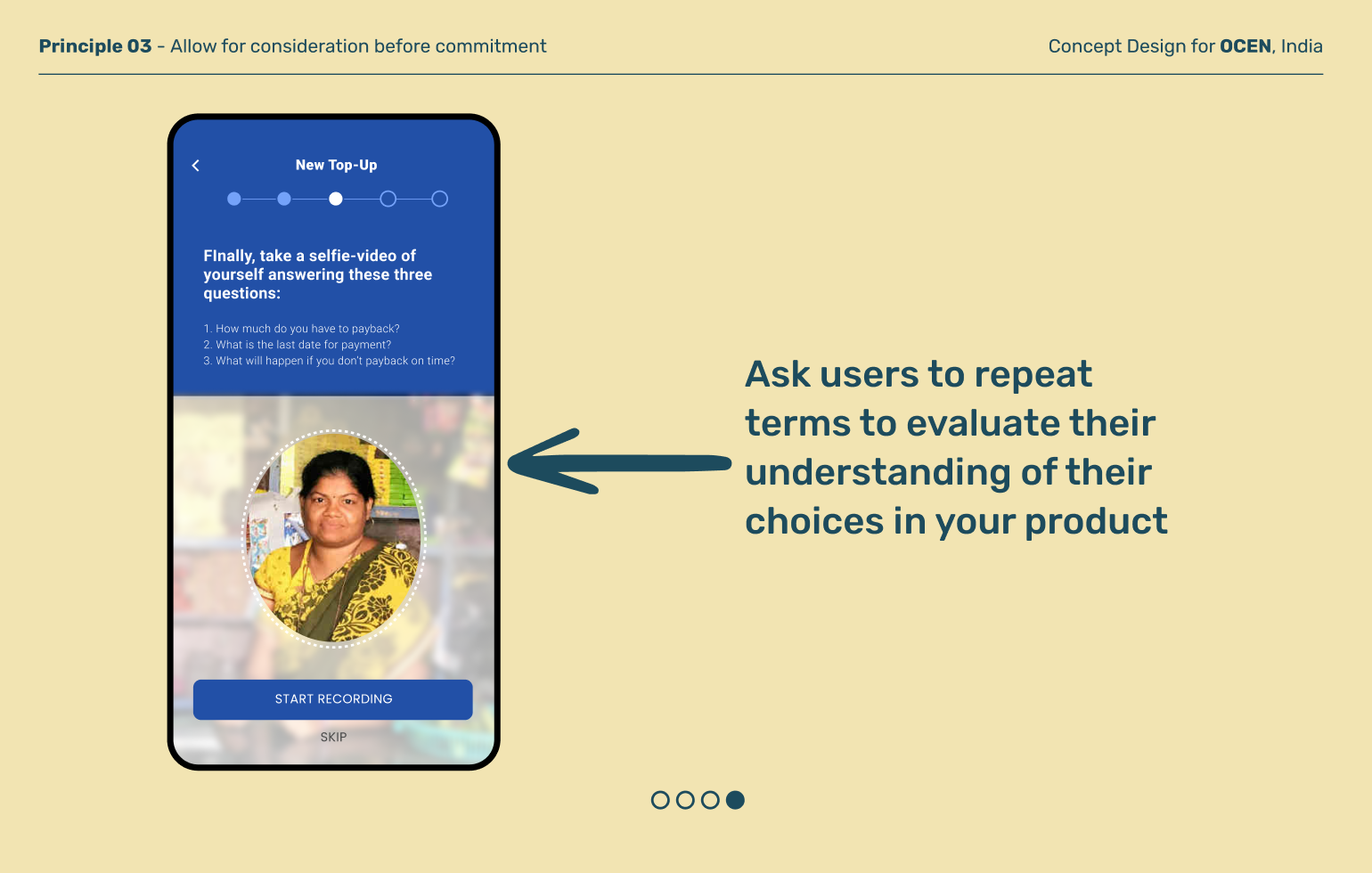

Allow for consideration before commitment

Principle 03

Taking out a loan is a big decision, especially if the repayment is tied to a higher risk endeavor like business growth Don’t rush this moment. Help users slow down and internalize key terms so that they can make careful decisions.

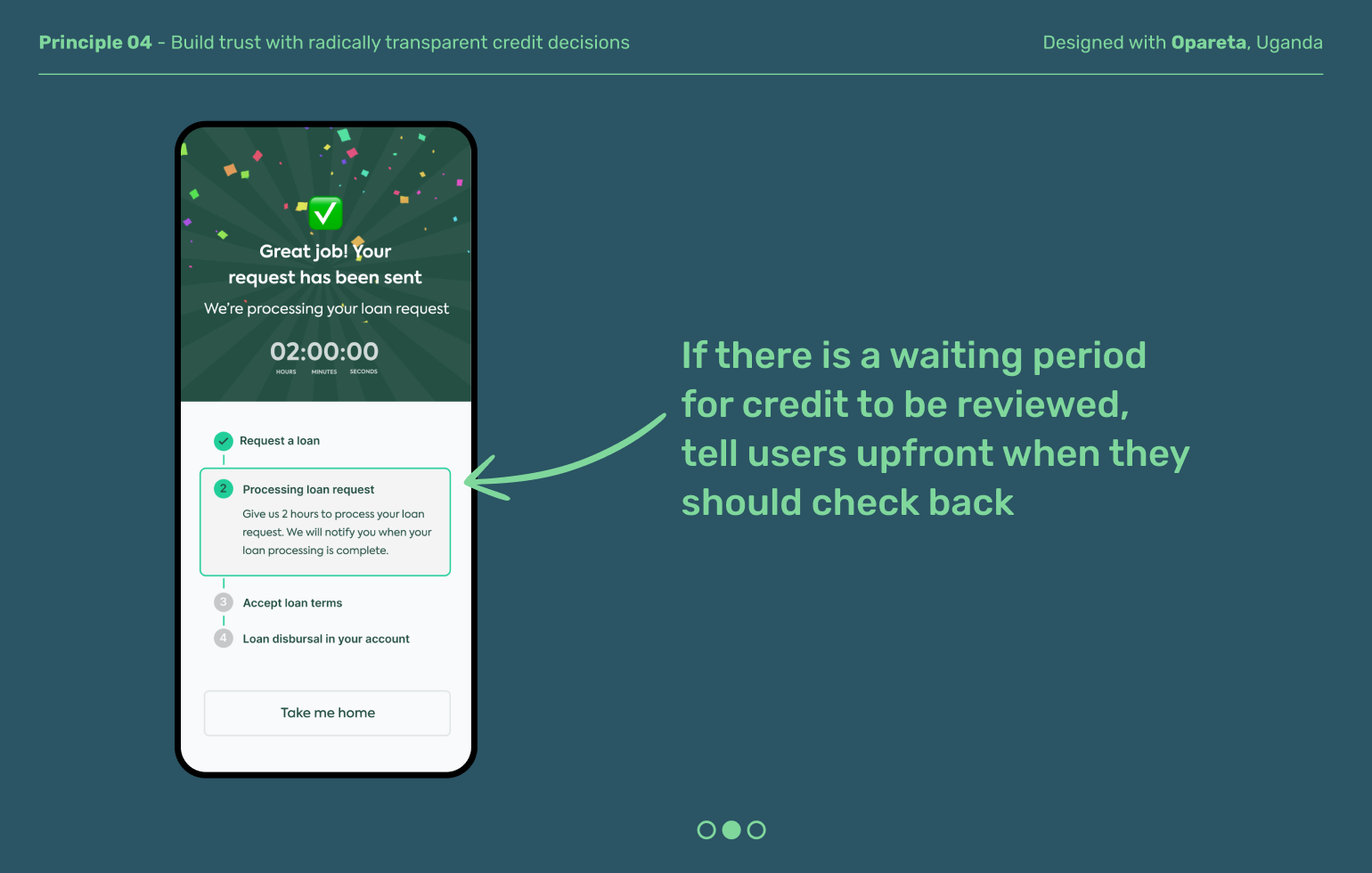

Build trust with radically transparent credit decisions

Principle 04

Most credit products have a waiting period while a loan application is being evaluated. Reduce user anxiety and frustration by clearly explaining decision timelines, and highlight actions they can take now.

Explore other moments in Credit