Group-based Lending

Rotational savings and credit groups are common ways people in the last mile interact with financial services. Empower members and bookkeepers with trust and transparency

Principles at a glance

-

01

Provide the full picture at a glance to the bookkeepers of the group

↓

-

02

Use digital to give physical conversations superpowers

↓

Principles in action

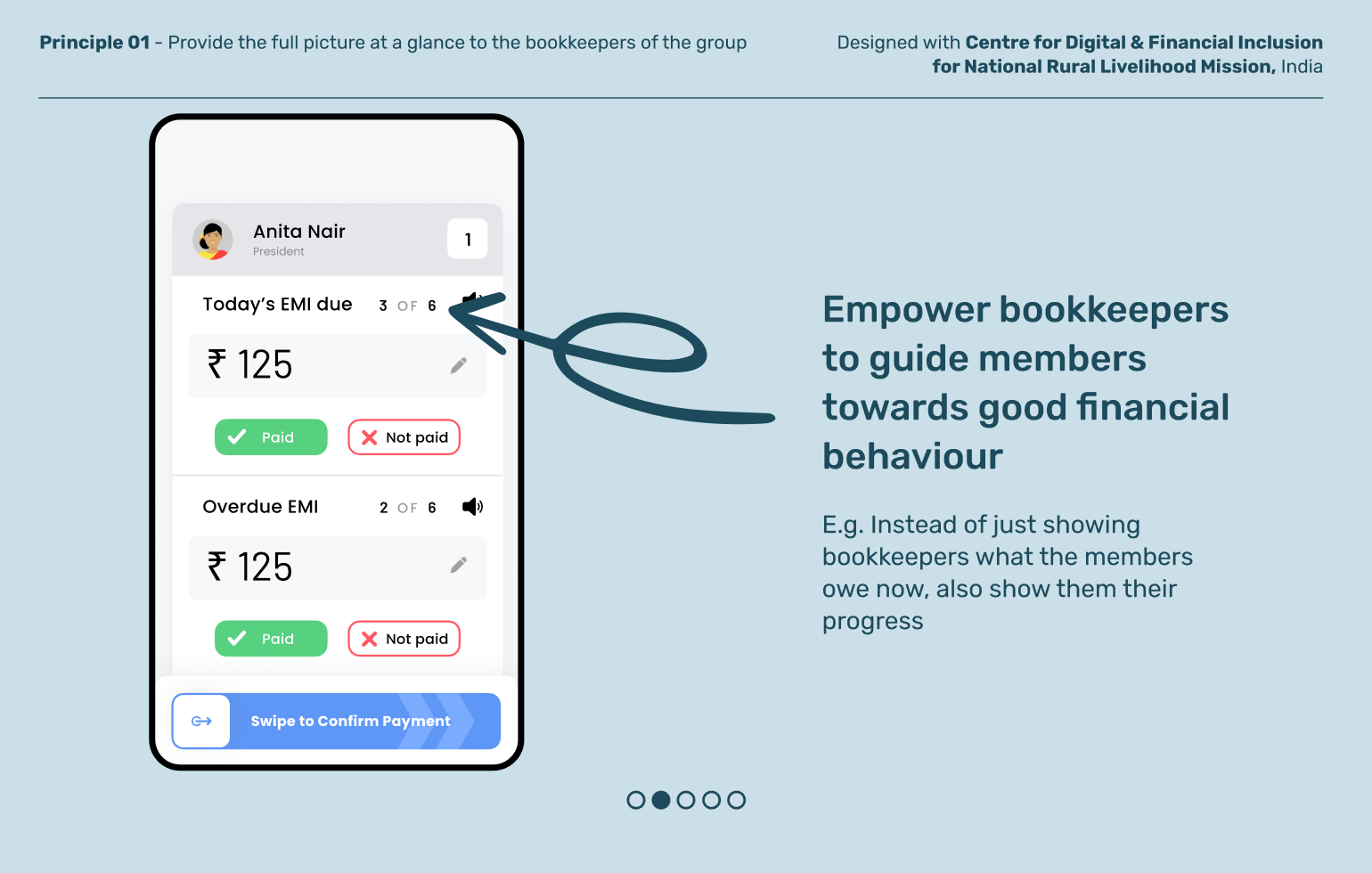

Provide the full picture at a glance to the bookkeepers of the group

Principle 01

Bookkeepers in savings groups are often tasked with managing cash flow and ensuring that transactions are in order. Sometimes, they are group members, sometimes agents. Giving these bookkeepers access to key information of the group like balance or upcoming due dates can help them serve their members better and foster a strong group dynamic.

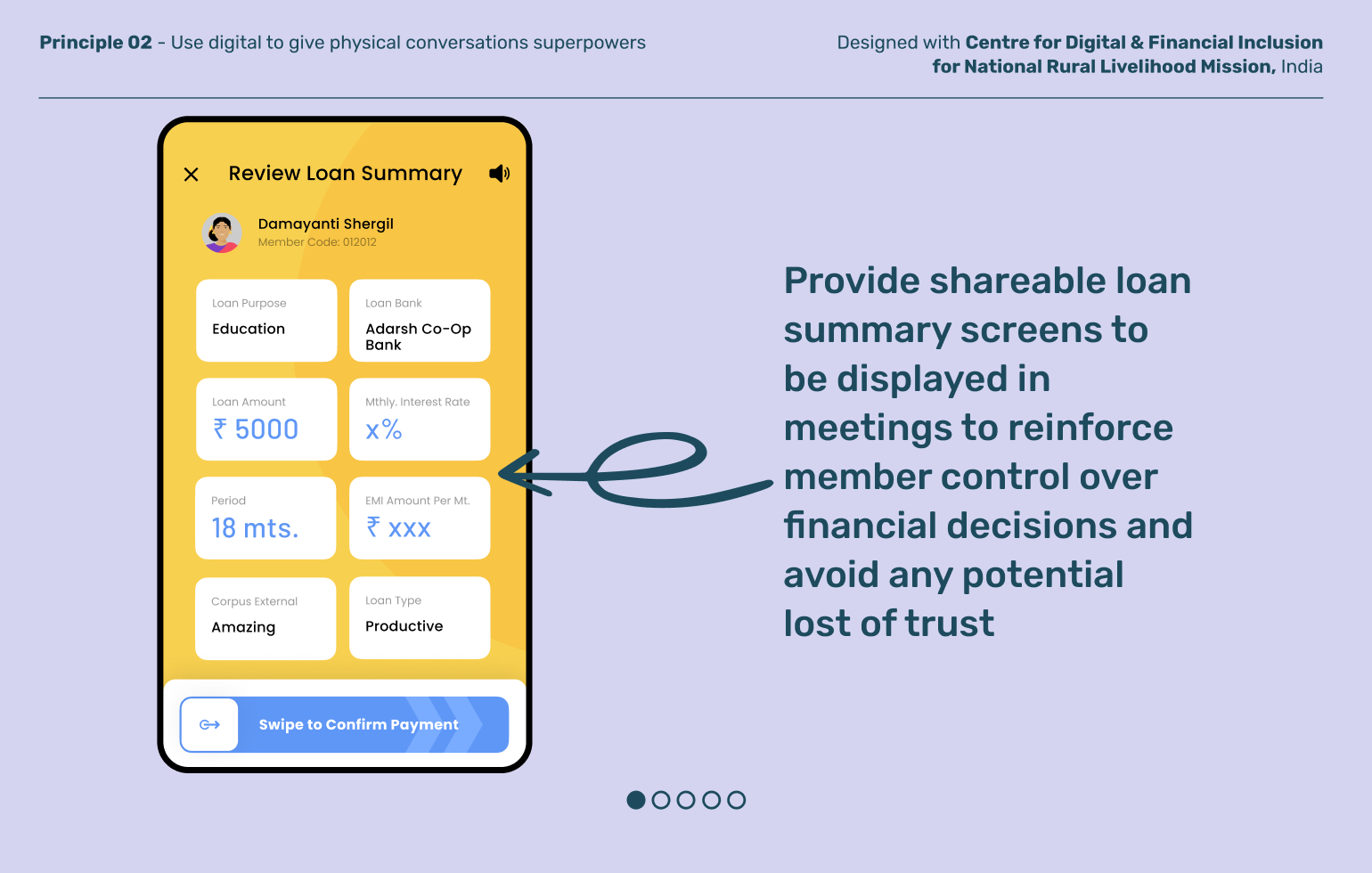

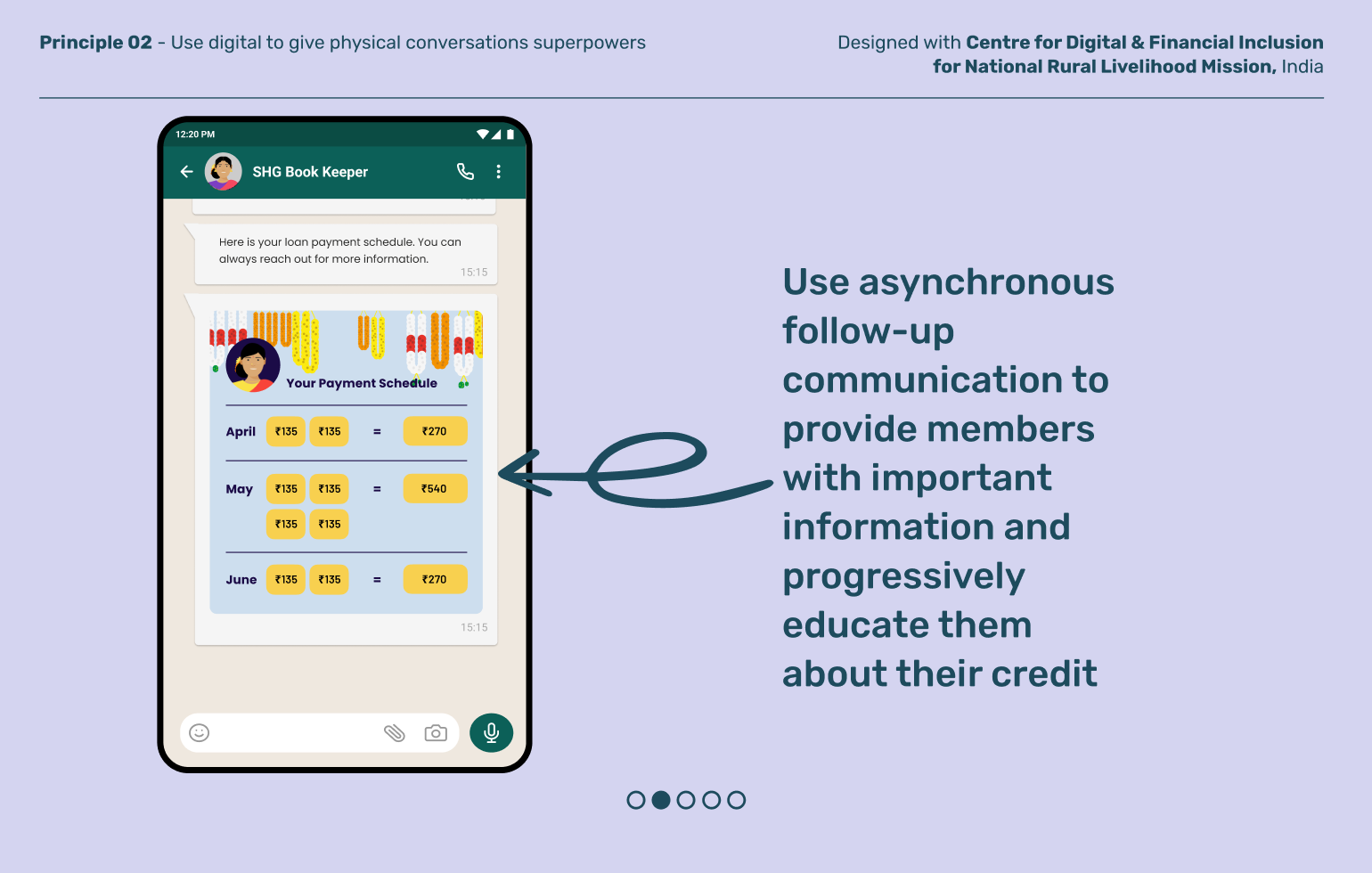

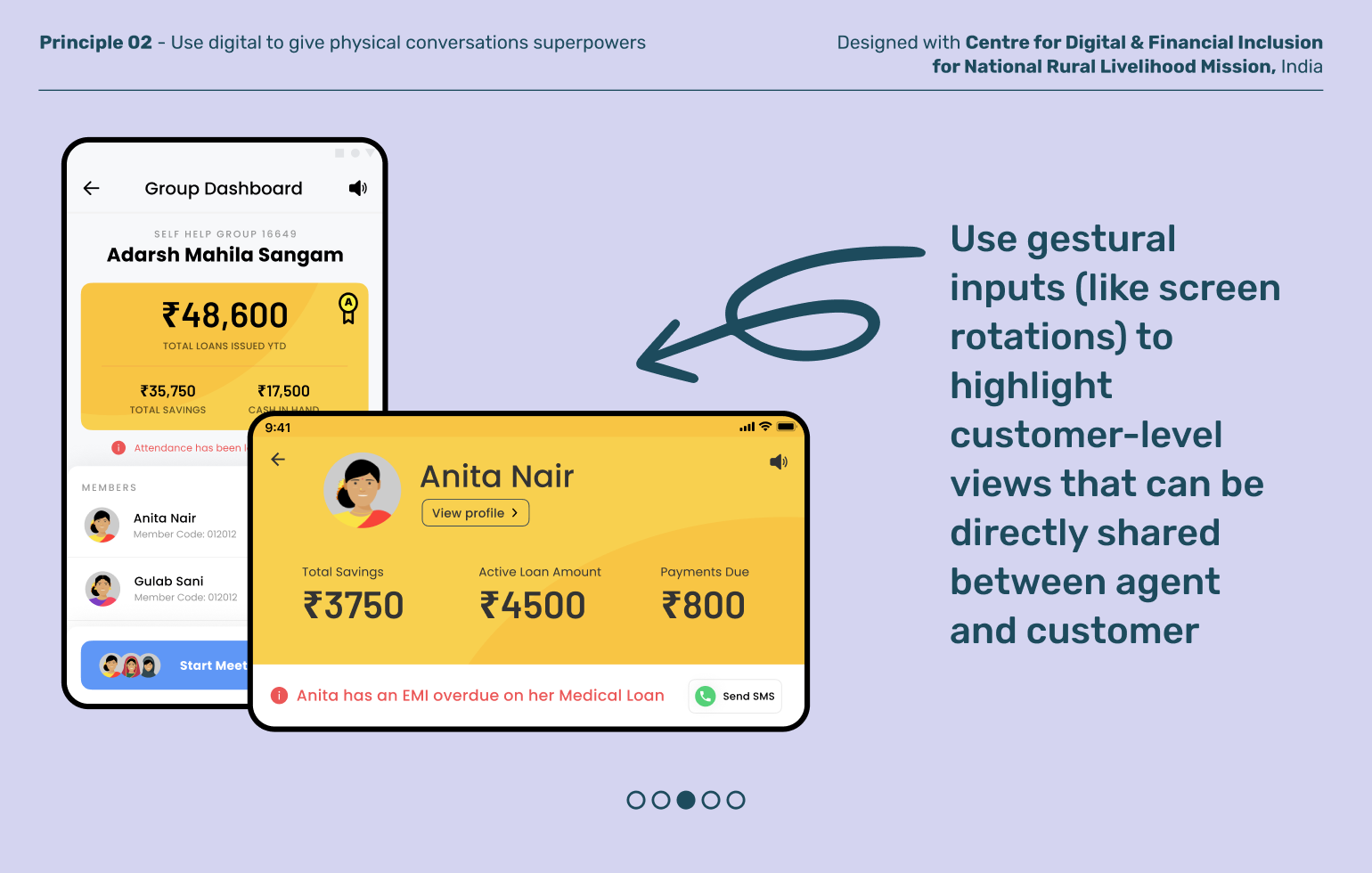

Principle 02

Use digital to give physical conversations superpowers

Trust, transparency and accountability are important tenets in group-based lending because they help to build strong relationships between the members of the group and create a sense of individual and joint responsibility. Done well, group lending can promote financial stability and encourage timely deposits and loan repayments.

Explore other moments in Credit