Agent-Driven Collections

Cash reigns supreme in many markets, so make deposits easy with accessible, agent-driven collections.

Principles at a glance

-

01

Provide shortcuts to increase agent efficiency

↓

-

02

Provide the full picture at a glance

↓

-

03

Use transparency to jumpstart trust & relationships

↓

Principles in action

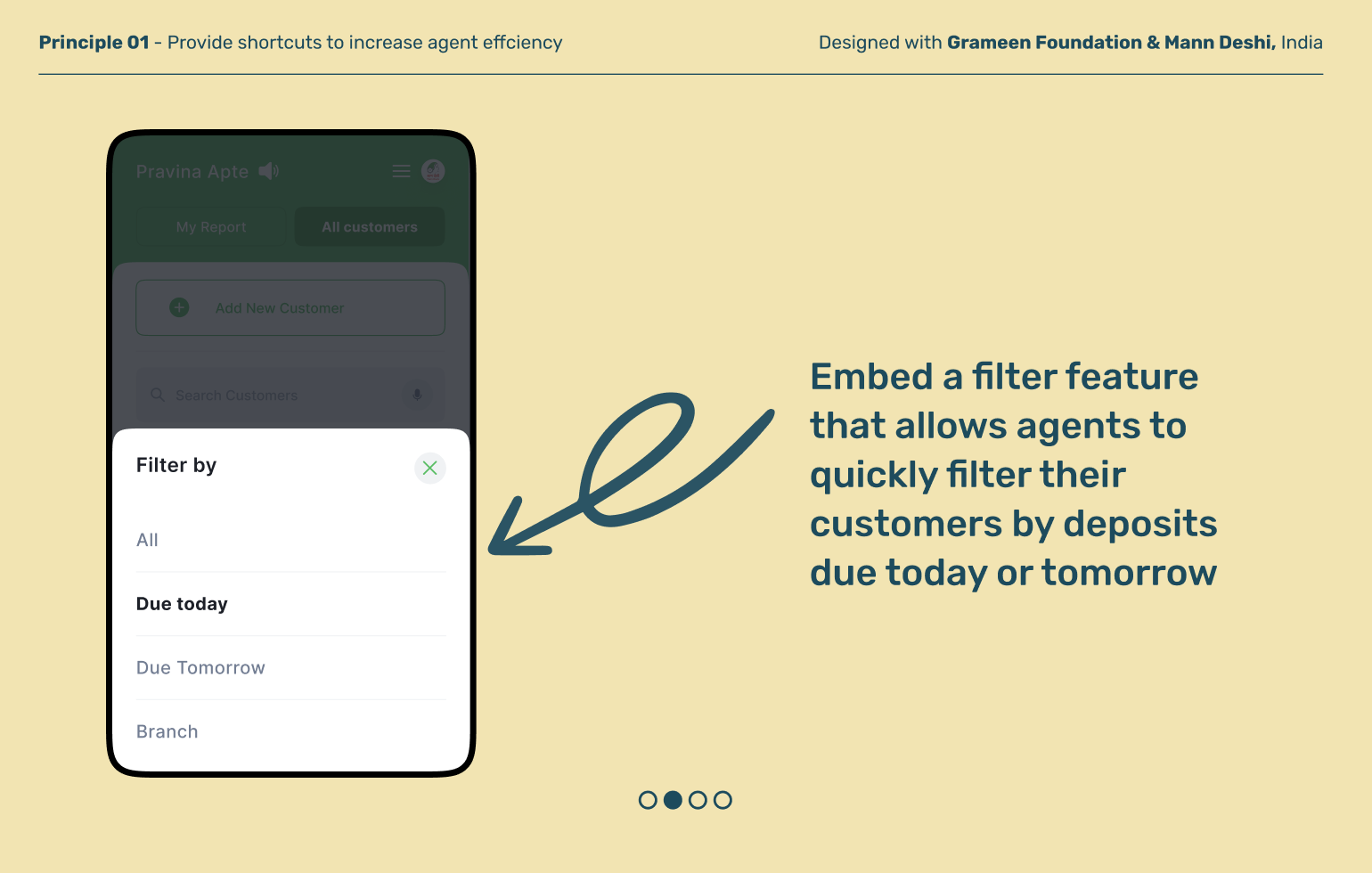

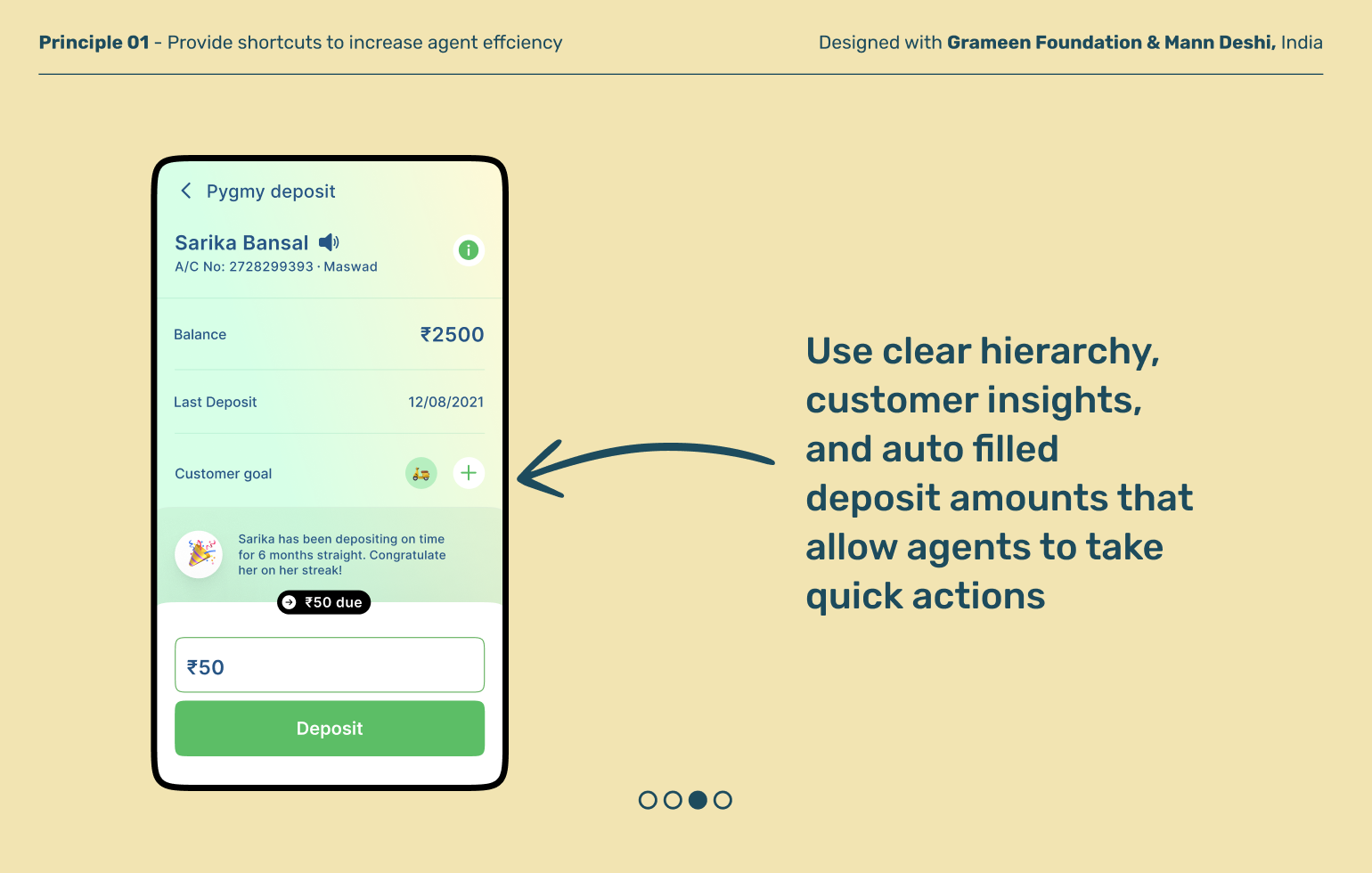

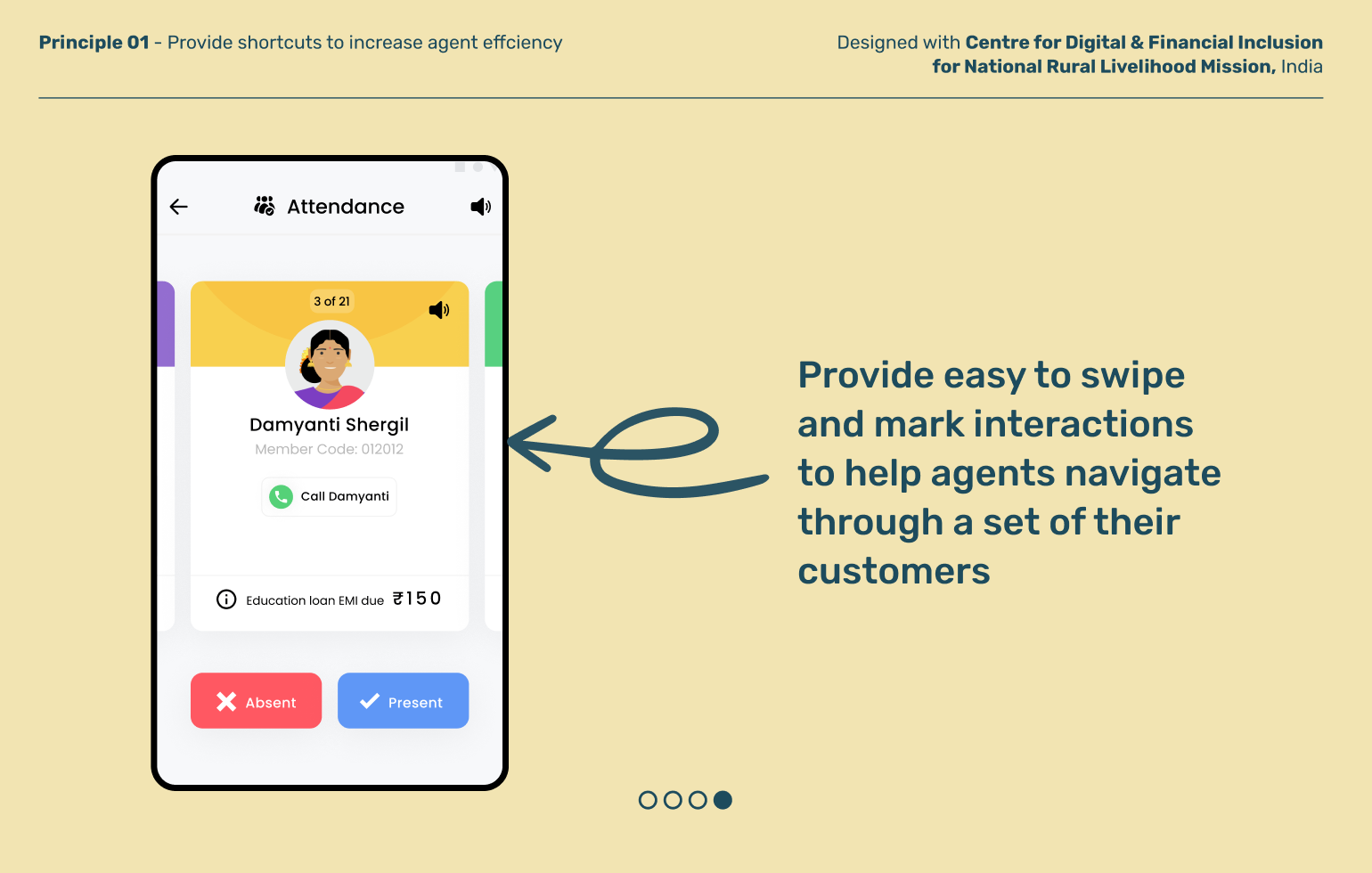

Provide shortcuts to increase agent efficiency

Principle 01

Agents typically have long days covering multiple customers to meet quotas. Build in quick work-paths and shortcuts so they can focus on building strong customer relationships, not data entry, while collecting savings deposits.

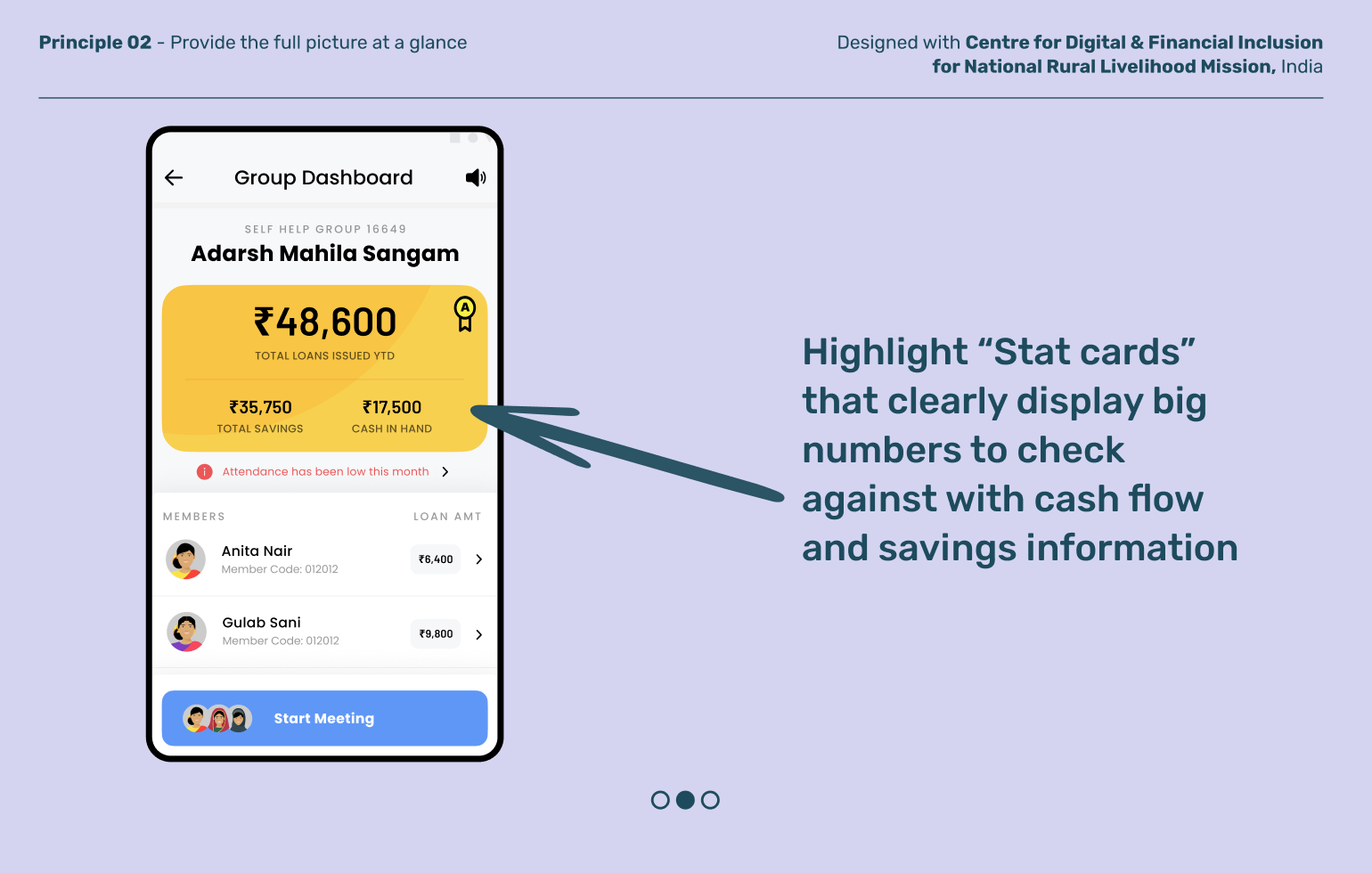

Principle 02

Provide the full picture at a glance

Last mile users often don’t have access to their account information at hand, and lean on agents to answer their inquiries and give them their financial picture when they collect deposits. Giving agents access to key information like balance or upcoming due dates can help them serve their customers better.

Use transparency to jumpstart trust & relationships

Principle 03

At the beginning of a customer-agent relationship, trust is low and customers are worried that something might go wrong. Using real time transparency on both the customer and agent device can help build trust in these moments and facilitate a stronger relationship for both parties.

Explore other moments in Savings