Principles at a glance

-

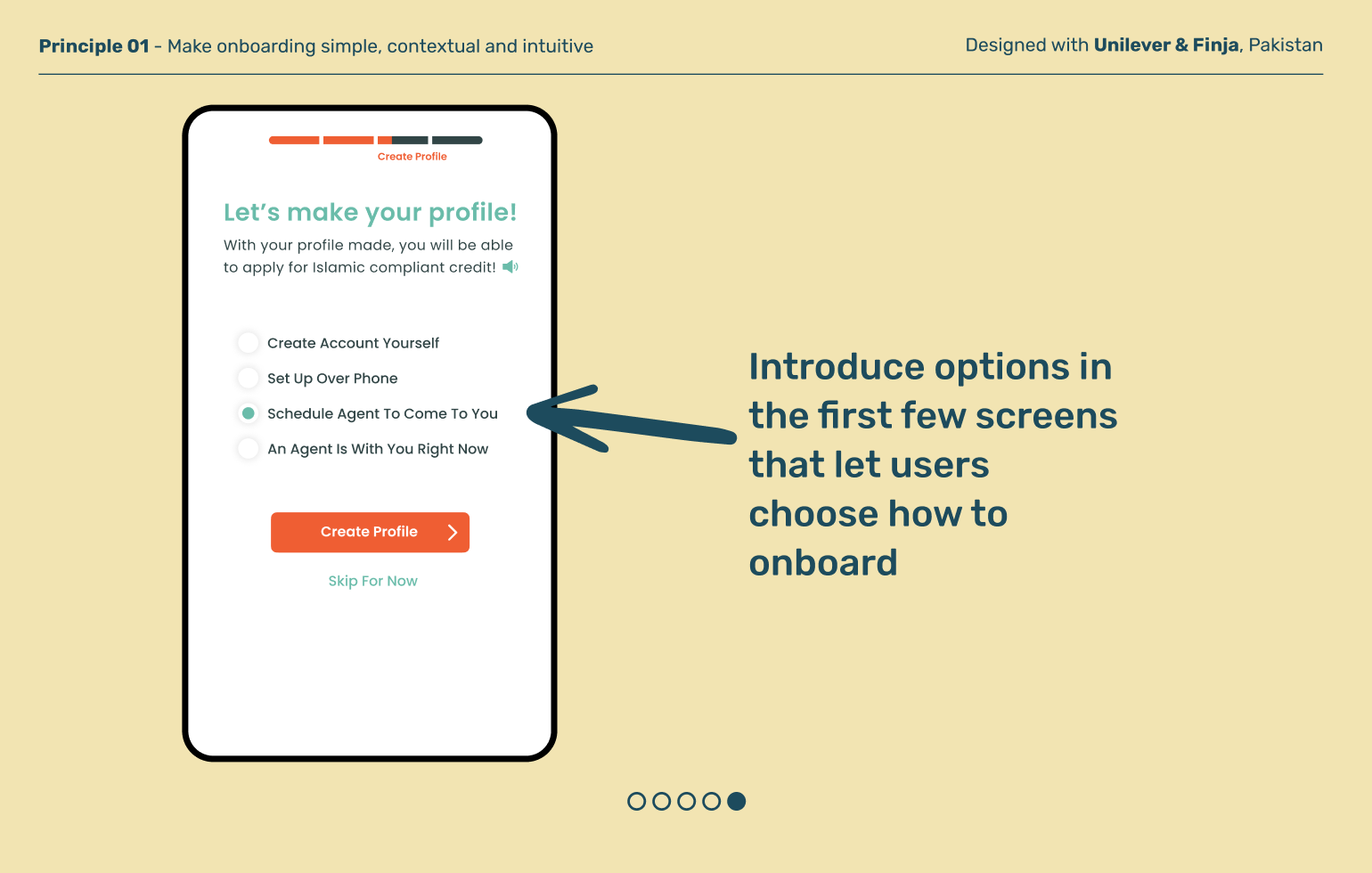

01

Make onboarding simple, contextual and intuitive

↓

-

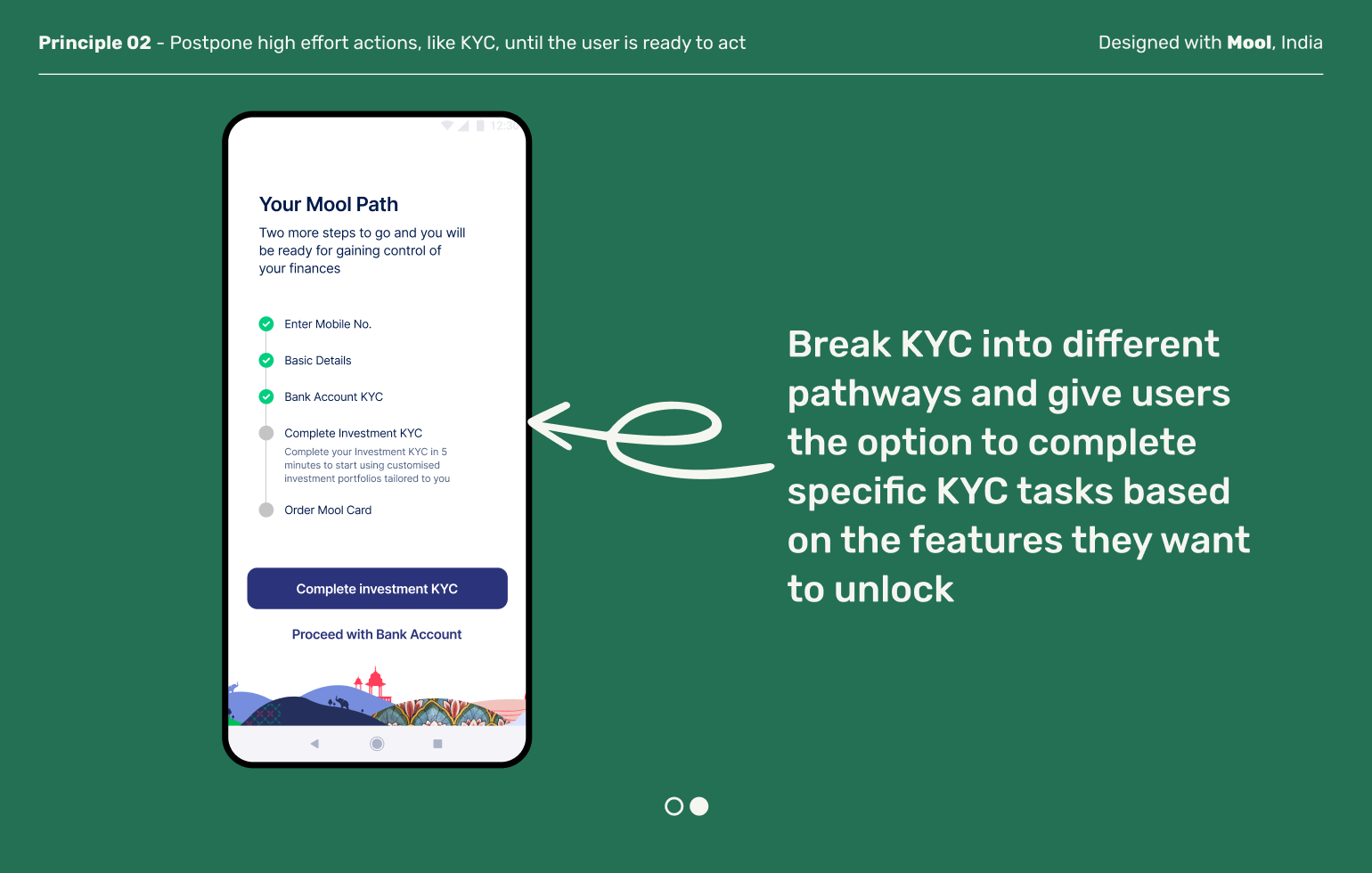

02

Postpone high effort actions, like KYC, until the user is ready to act

↓

-

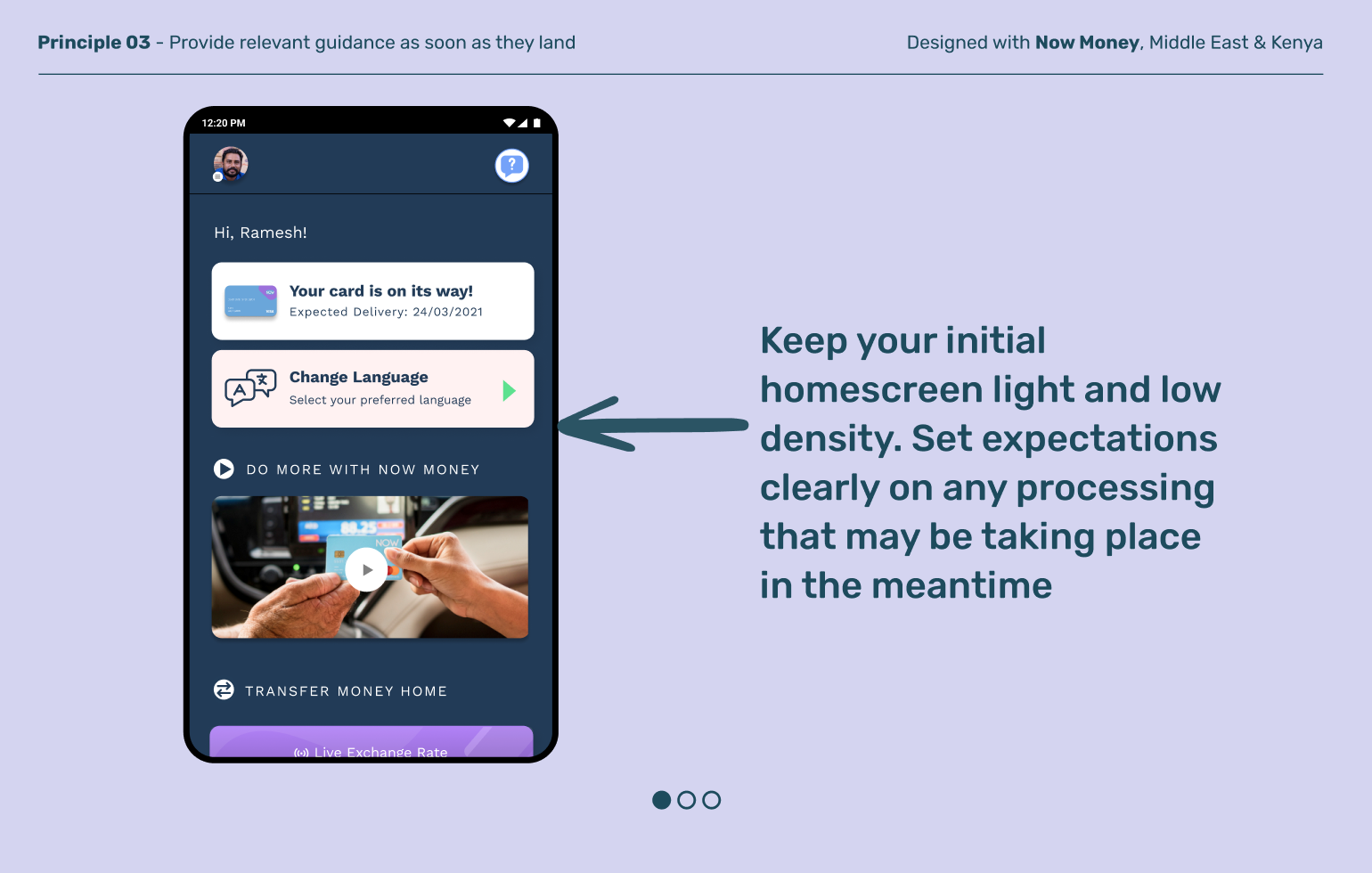

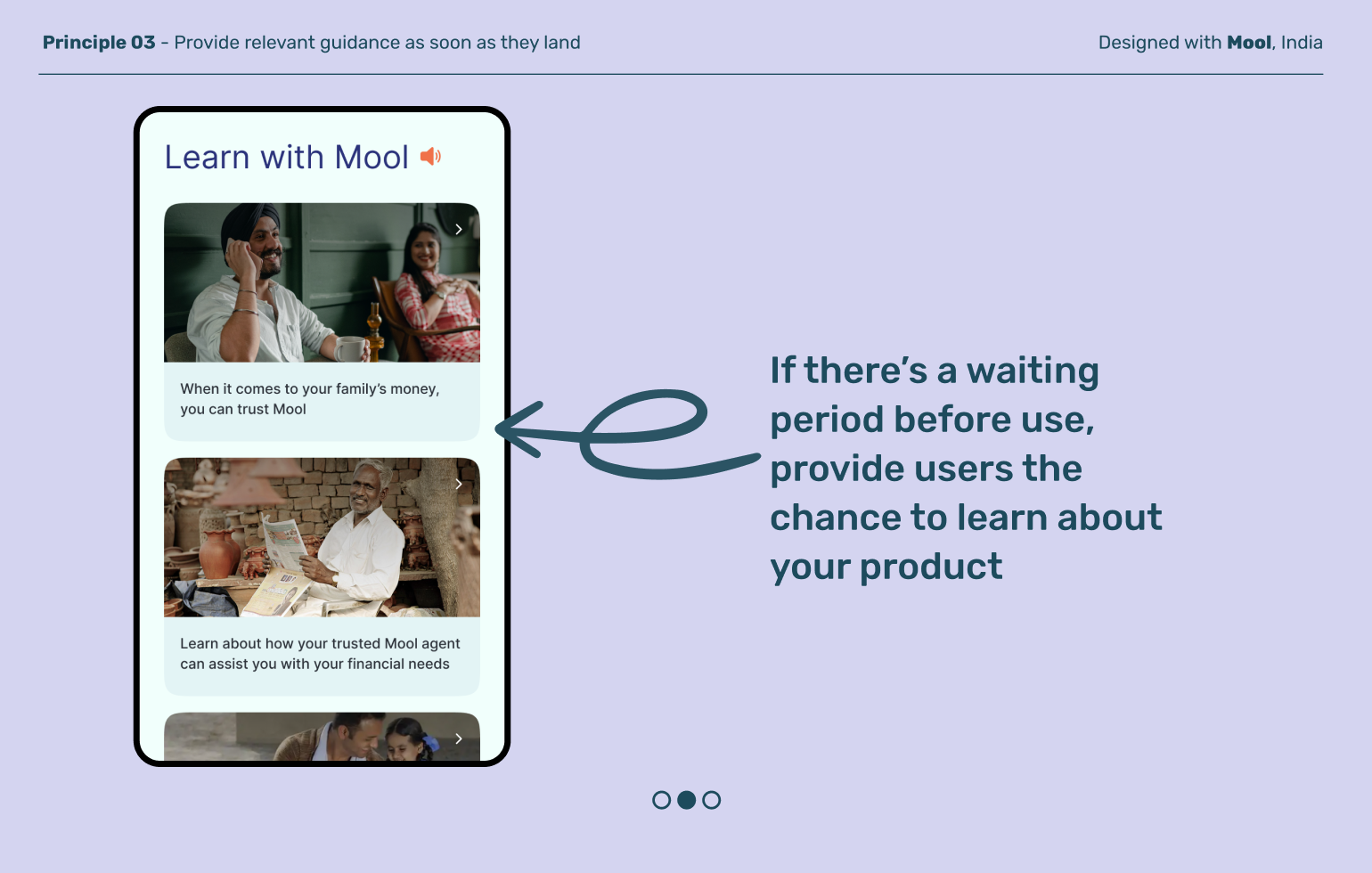

03

Provide relevant guidance as soon as they land

↓

Principles in action

Make onboarding simple, contextual and intuitive

Principle 01

The first interaction is a make or break moment for low income users. It’s important to reduce the friction to a minimum, enabling users to jump into the experience seamlessly and build on their curiosity. Onboarding flows should feel personal, relevant and exciting.

Principle 02

Postpone high effort actions, like KYC, until the user is ready

First time users are often nervous about unforeseen consequences of financial services, especially entirely digital ones. Allowing users to engage and get familiar with what your product is and understand your value proposition, before they make big commitments of time or capital, builds confidence and trust

Principle 03

Provide relevant guidance as soon as they land

A digital bank offers a range of services, but that can feel overwhelming to first time users who have never interacted with formal finance on their own. Presenting users with a well designed home page that’s organized by necessary information encourages exploration.

Explore other moments in Digital Banking