Cash Management

Targeted education, better tools, and new ways to rebalance can help agents better serve customers and manage liquidity

Principles at a glance

-

01

Anchor liquidity management in earning potential

↓

-

02

Help agents predict the variability of their business

↓

-

03

Help agents make informed choices among their multiple liquidity options

↓

-

04

Accommodate urgent liquidity needs as well as regular top-ups

↓

Principles in action

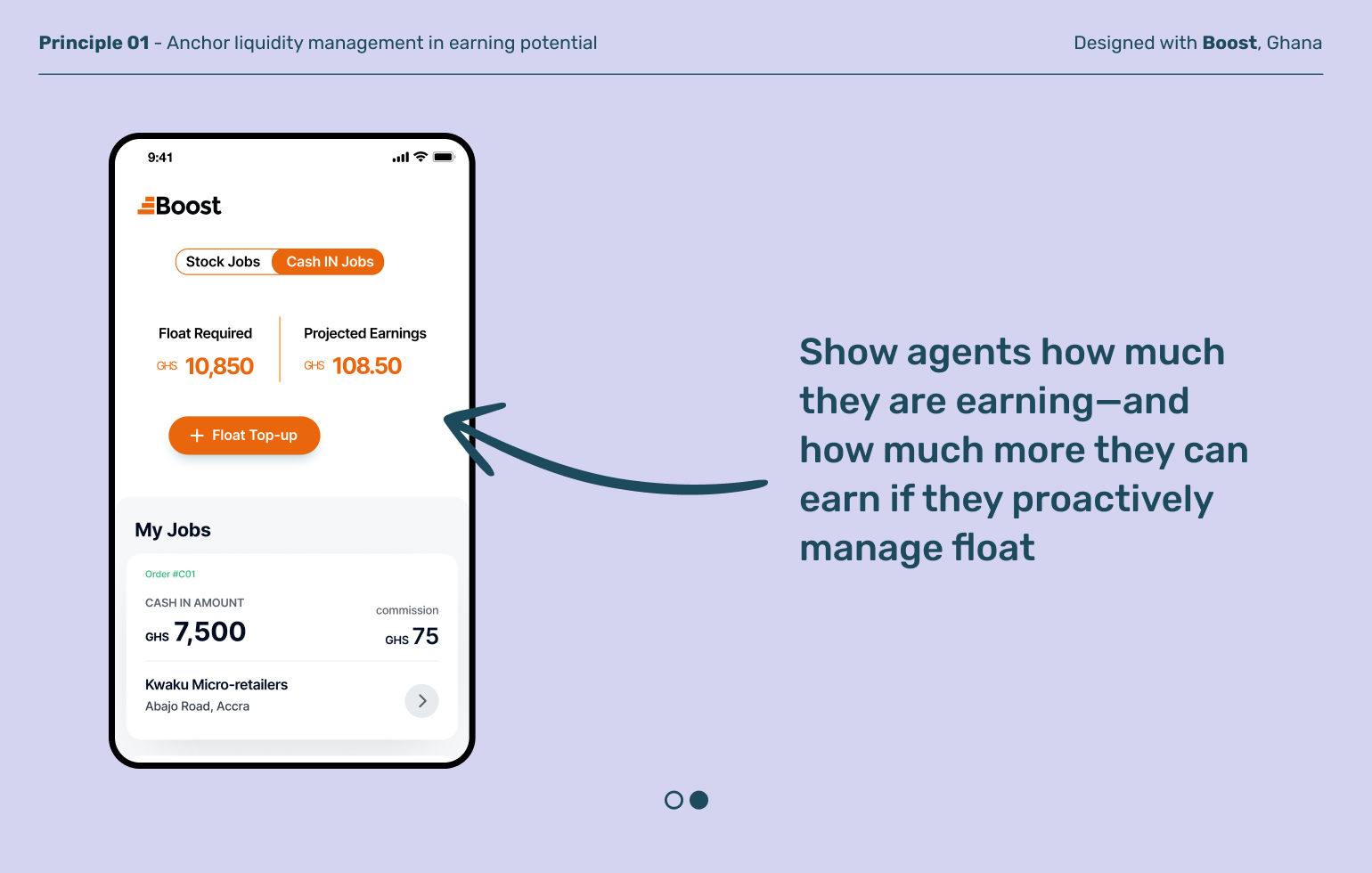

Anchor liquidity management in earning potential

Principle 01

Agents are businesspeople, often considering which efforts will maximize profits. Managing working capital, juggling multiple businesses, and tracking expenses in their heads or on pen-and-paper can be overwhelming. The complexity of managing liquidity can add to an already-full load. Clearly articulating the value proposition of greater liquidity and offering better tools to rebalance can help agents grow their businesses.

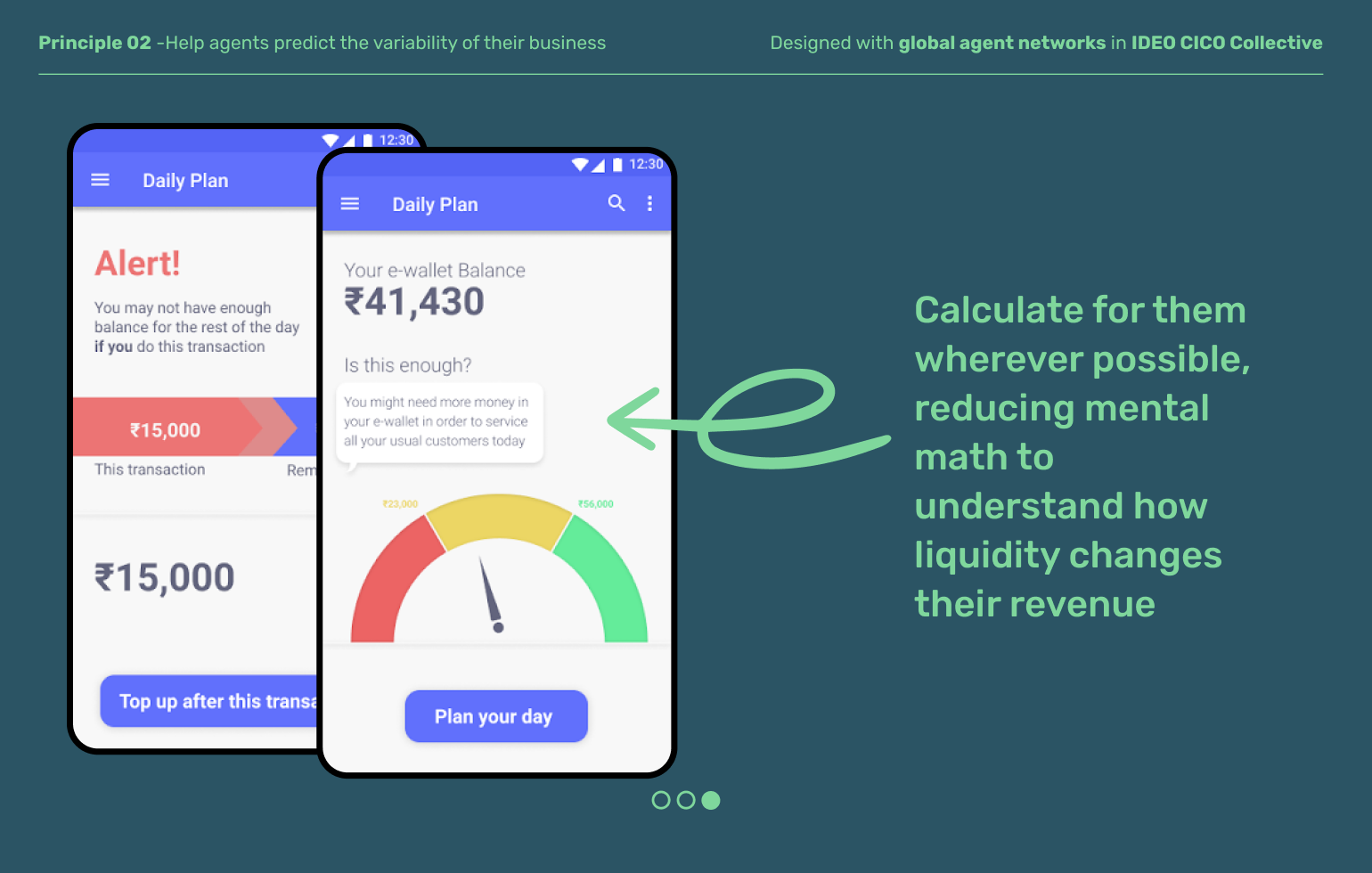

Principle 02

Help agents predict the variability of their business

Agent businesses are often spiky—payday might bring a number of people to their shop, while they might go hours or days at other time without a transaction. Better tools can help even the smallest agent prepare for ups and downs. Reduce the cognitive bandwidth required for liquidity calculations and capital management and offer nudges that help agents stay one step ahead.

Principle 03

Help agents make informed choices among multiple liquidity options

Many agents rely on both formal and informal solutions to rebalance liquidity. To introduce new rebalancing options, explain benefits over existing solutions, provide reasons to trust and highlight how choosing a new option still offers protection from fraud—a key concern among agents.

Principle 04

Accommodate urgent liquidity needs alongside regular top-ups

Agents treat urgent rebalancing needs differently from regular ones. They are willing to pay more to top-up quickly, e.g., to fulfill a large transaction for a key customer. In moments of urgency, agents prefer rebalancing that doesn’t require them to leave their shop and lose business. For regular rebalancing needs, agents may prefer lower-cost, more traditional methods (like visiting a branch to withdraw). Offering convenience and peace of mind with scheduled rebalancing and competitive pricing in urgent moments can help.

Explore other moments in Agent Banking